Protecting low income communities in northern Cameroon

"Days of insurance and microinsurance" hosted by the Ministry of Finance of Cameroon

properties.trackTitle

properties.trackSubtitle

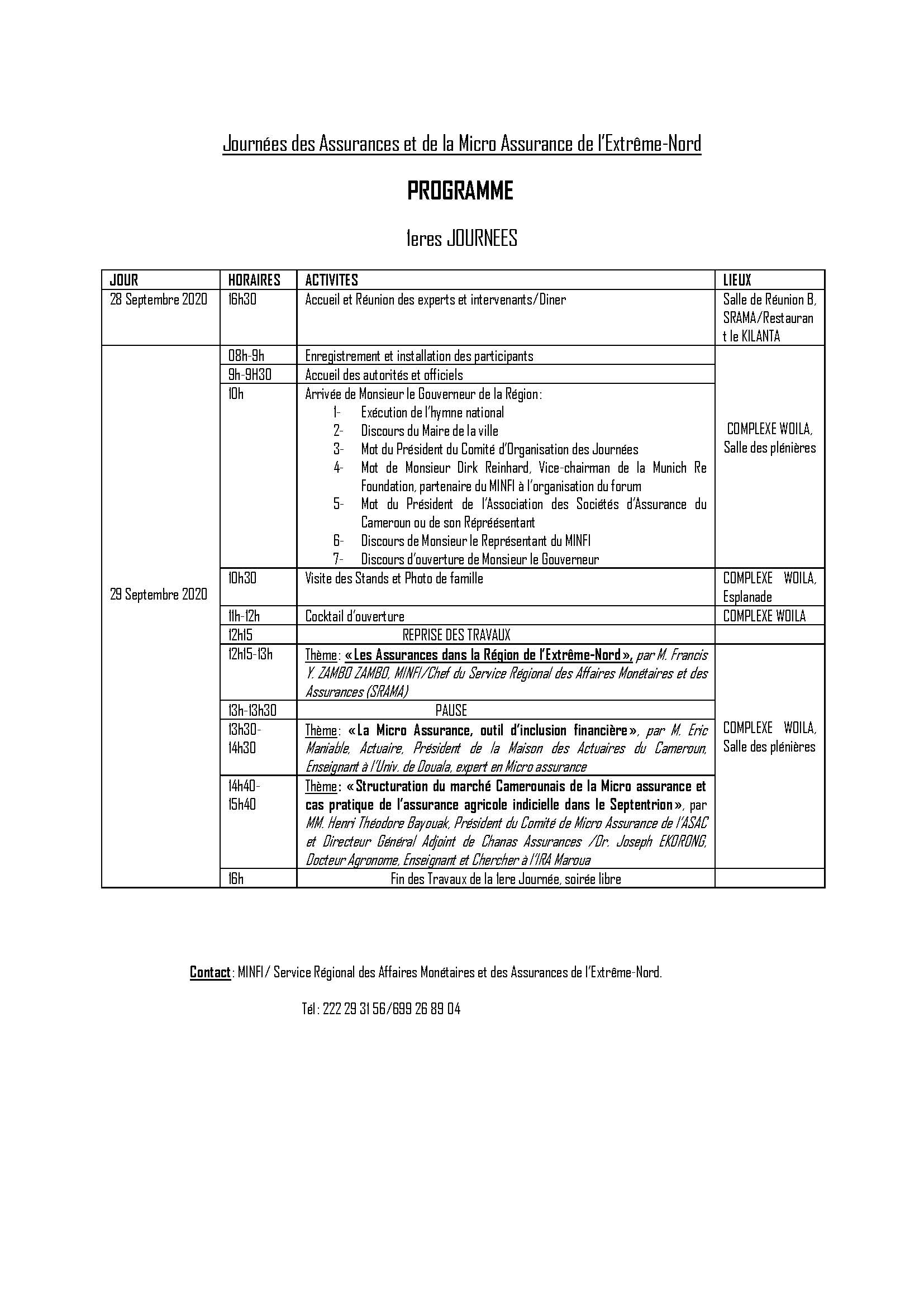

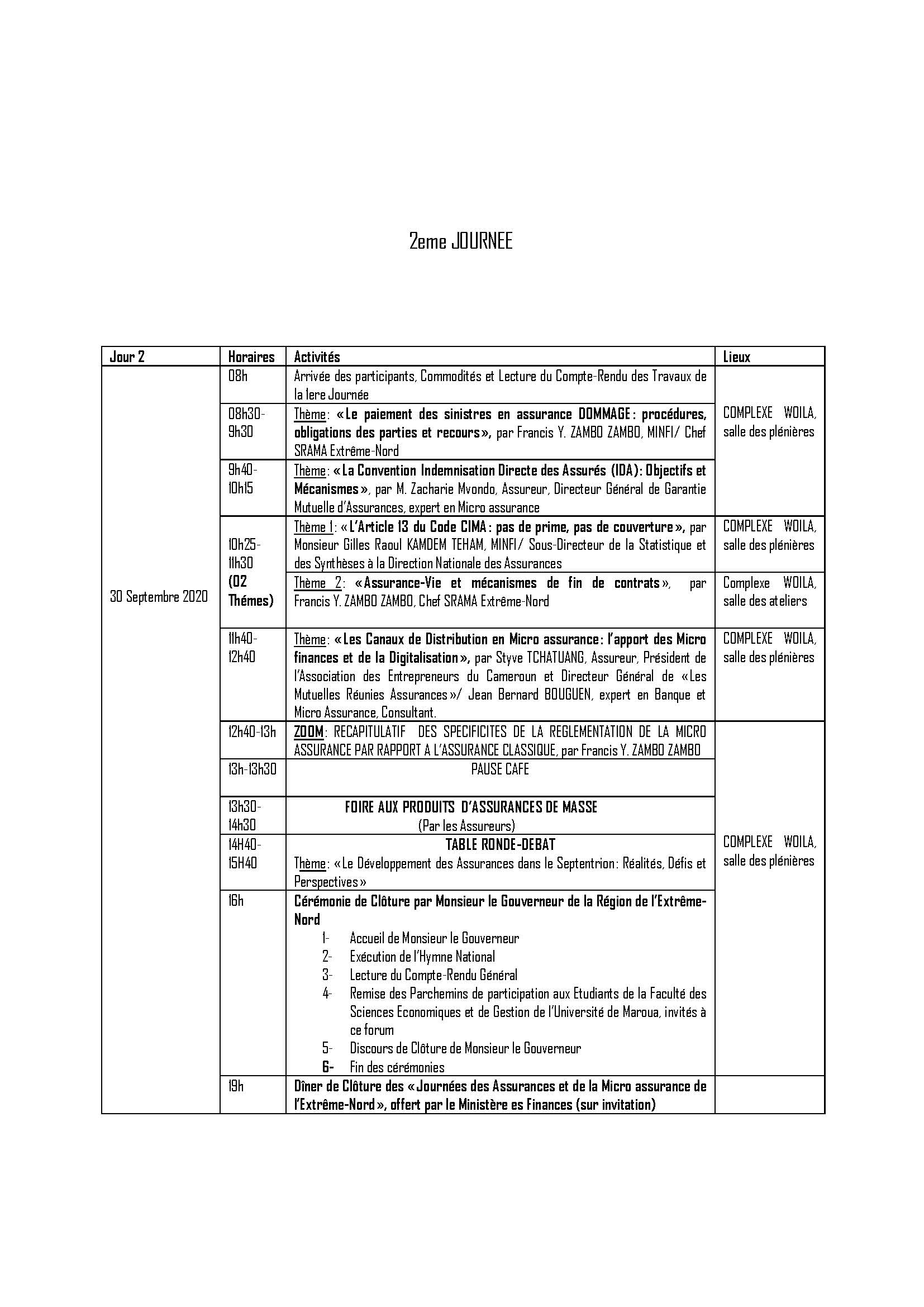

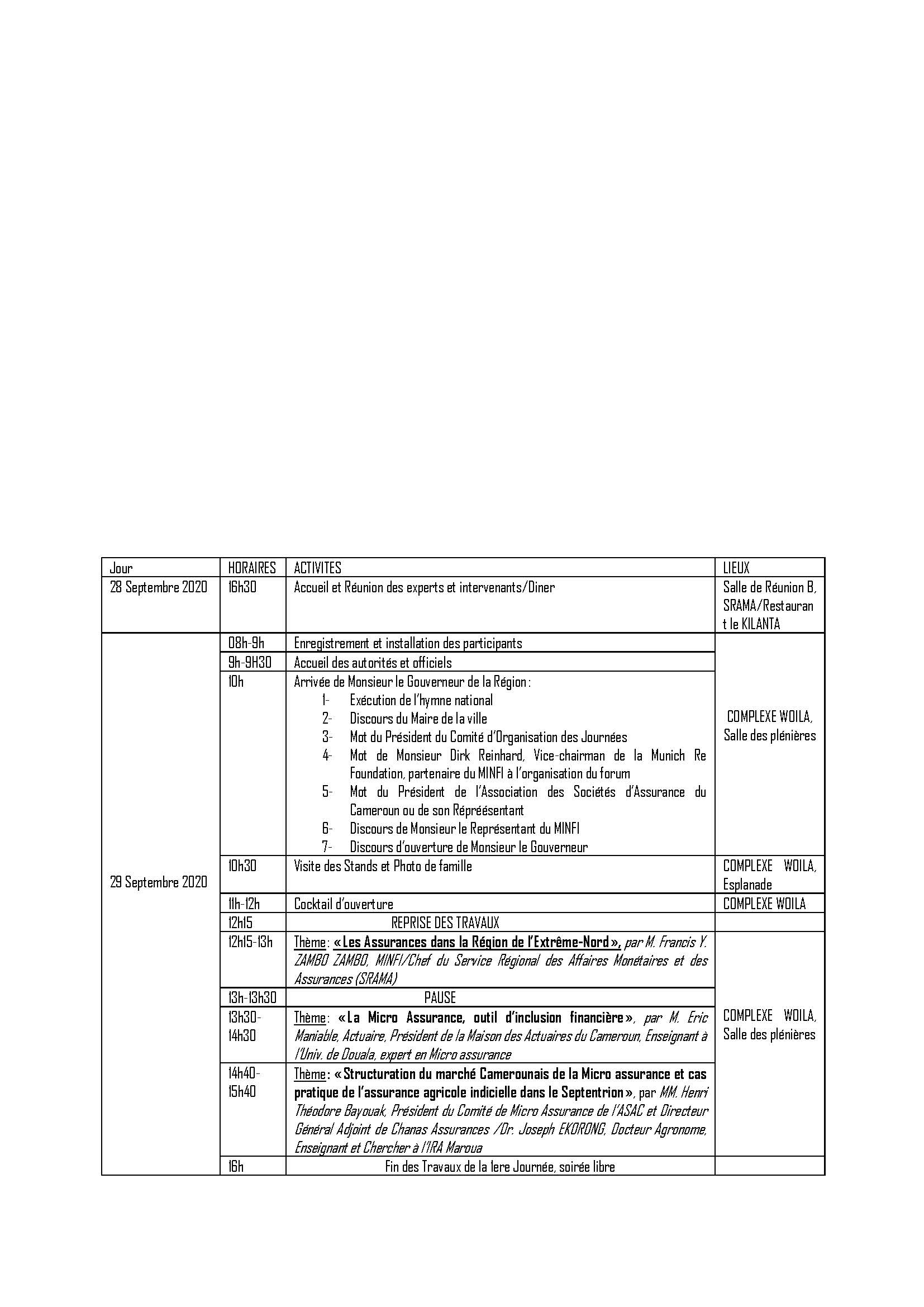

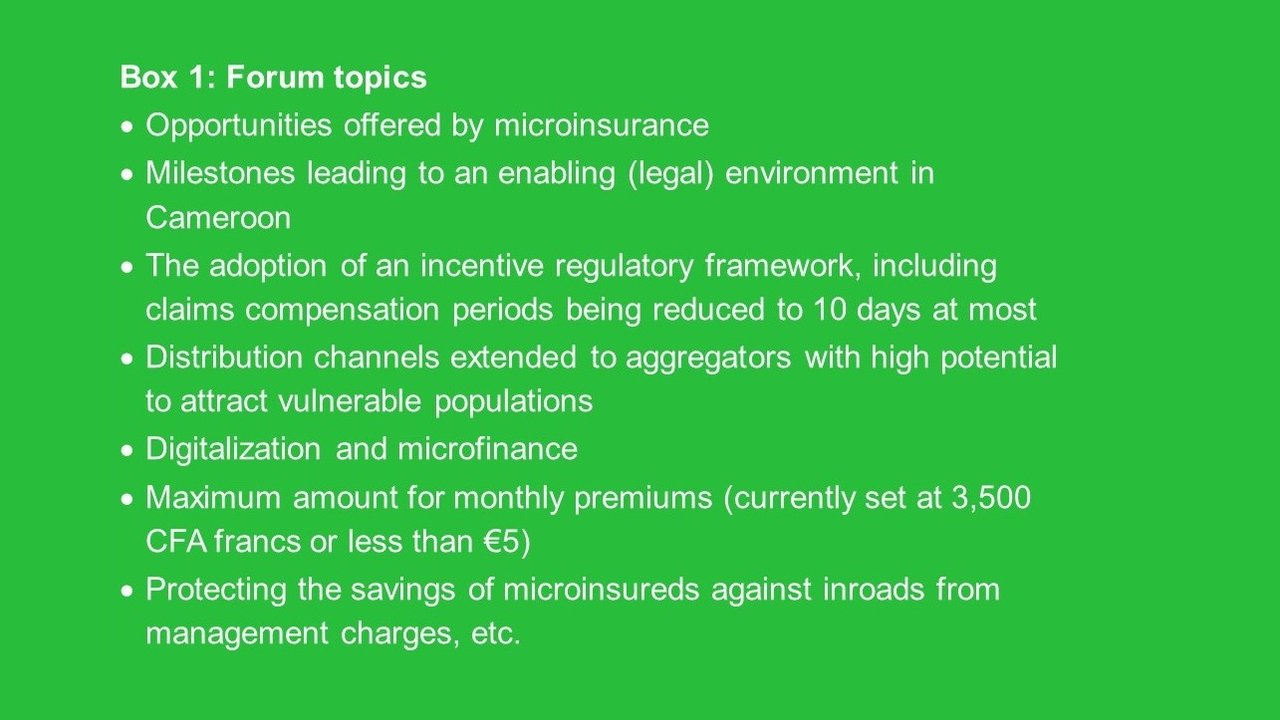

The forum "Days of Insurance and Microinsurance of the Far North” was hosted from 29–30 September 2020 in Maroua, Cameroon, the main hub in the northern tip of the country. The gathering of experts was set up under the patronage of the Cameroon Minister of Finance and Munich Re Foundation to enhance insurance services within the area. The main theme of the discussions was "Protecting the People of the North through Mass Insurance".

Fighting the causes of poverty

The Far North region of the country is plagued with issues of poverty that are at the core of development strategies undertaken by the government of Cameroon and multiple international organisations. Government authorities intended to intensify measures to reduce poverty through the generalised use of insurance cover against natural and health disasters (floods, fires and tropical season diseases) that regularly challenge income-generating activities due to their significant scale. In such an arid region as the Far North in Cameroon, the risks related to climate hazards are pre-eminent, given that crop growing (cotton, corn, and sorghum) and livestock farming are the main business activities. Moreover, over the years the regulator has emphasised the monitoring of road accidents, which have impacted young people in great numbers, particularly those riding motorcycles as taxis.

Raising awareness in times of Covid-19

Despite the Covid-19 pandemic, the forum was well attended by the general public, with more than 500 people turning up over the course of the two days. They moved freely between the conference room and the esplanade, which were kept at half their available daily capacity for health and safety reasons. The participants were made up of individuals, heads of small and medium-sized enterprises, food companies, microfinance organisations, officials (who daily supervise populations in the field through agricultural associations such as the National Confederation of Cotton Producers of Cameroon with 280,000 members), mutual health organisations, community interest groups (GIC), motorcycle taxi-drivers' associations, women involved in food retailing, traders, elected local officials from local territorial communities, regional authorities, etc.

The presence of so many participants and their diversity was mainly thanks to active support from the administrative and political authorities, the leaders of religious groups with a strong foothold in the Far North Region, and other opinion leaders. For example, the regional Governor, the highest administrative authority in the area, launched the forum activities surrounded by many influential people in a picturesque ceremony marked by cultural parades that are typical of the region. The key participants were approached by the organising committee beforehand to explain the potential benefits of the event in terms of raising the living standards of the population through increasing its awareness of bespoke microinsurance products. Throughout the forum, some of these leaders were in constant contact with the community, and shared their field experience to establish the population's risk coverage needs.

The strong mobilization also resulted from a well-received campaign by the Ministry of Finance and regional insurers, which was run most intensively on local radio and television. Promotions were in both French and local languages such as Fulfulde, which is spoken by more than 90% of the people in the area. It is also worth mentioning the presence of more than 50 students from the University of Maroua, who were keen to explore alternative approaches to insurance issues and helped disseminate the work of the event on social media.

Learning from experience

An update was presented during the forum on the progress of microinsurance programmes in the country, particularly in the three northern regions, where an index-based agricultural microinsurance programme is under way to cover thousands of cotton producers . In addition, the organizers reserved time for insurers to present innovative microinsurance products adapted to the specific needs of the populations of the region. This helped stimulate networking between insurers and association representatives , as well as with microfinance representatives with a view to future partnerships.

The programme of the "Days of insurance and microinsurance"