2021 Inclusive Agriculture

Insurance Solutions Practitioners & Facilitators Seminar

28 September 2021 - Digital Edition

properties.trackTitle

properties.trackSubtitle

Building sustainable business models for inclusive agriculture insurance

Product benefit design

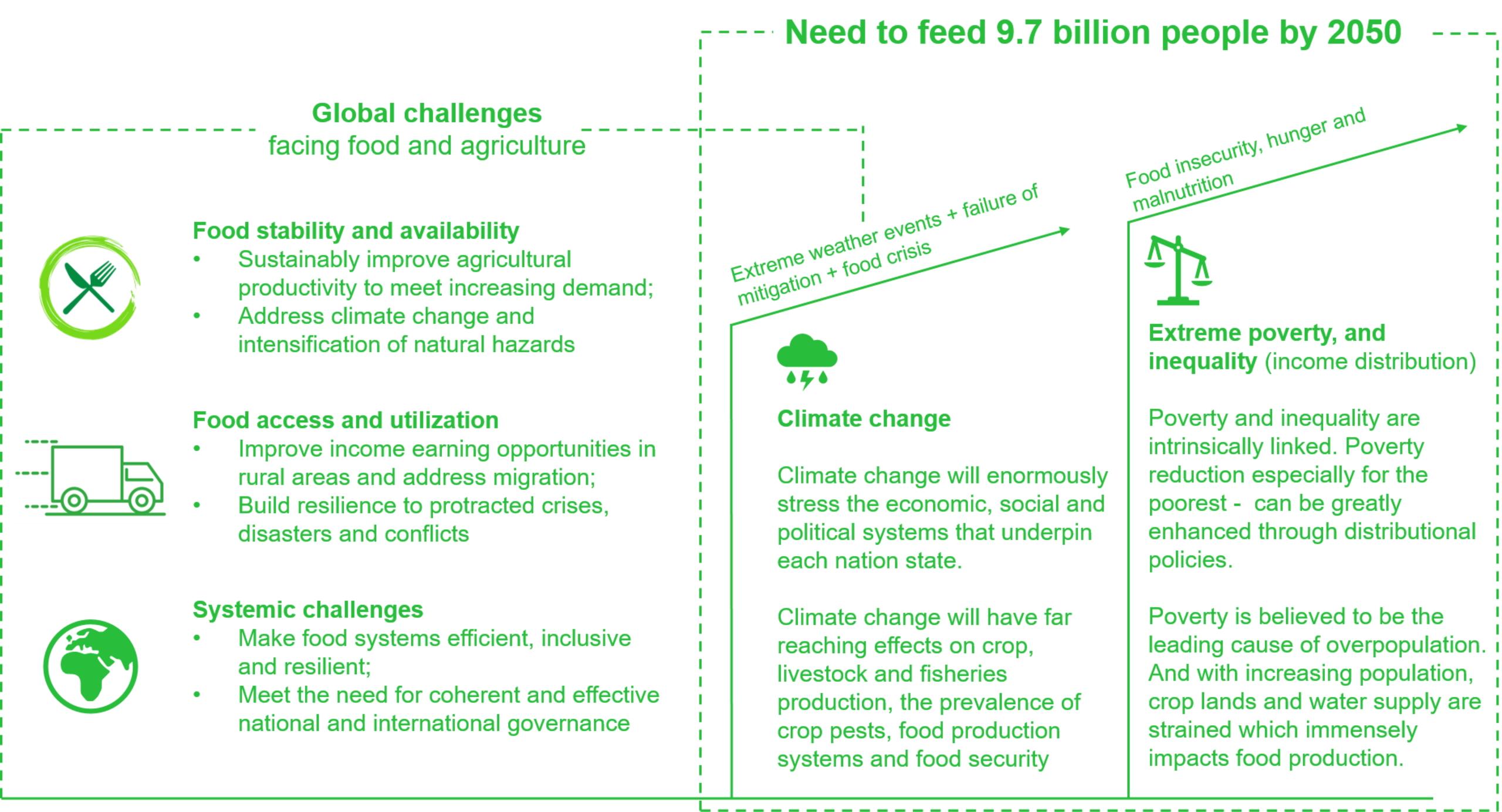

Bundling and embedding of insurance in agricultural inputs remain one of the key product design strategies for making agriculture insurance accessible and viable. Data availability for pricing and market analysis remains a challenge. The reliance on satellite imaging of weather patterns as alternative data sources has helped with index-based insurance. Rural households also face non-agricultural related risks, and bundling of agricultural and household risks often builds a better value proposition

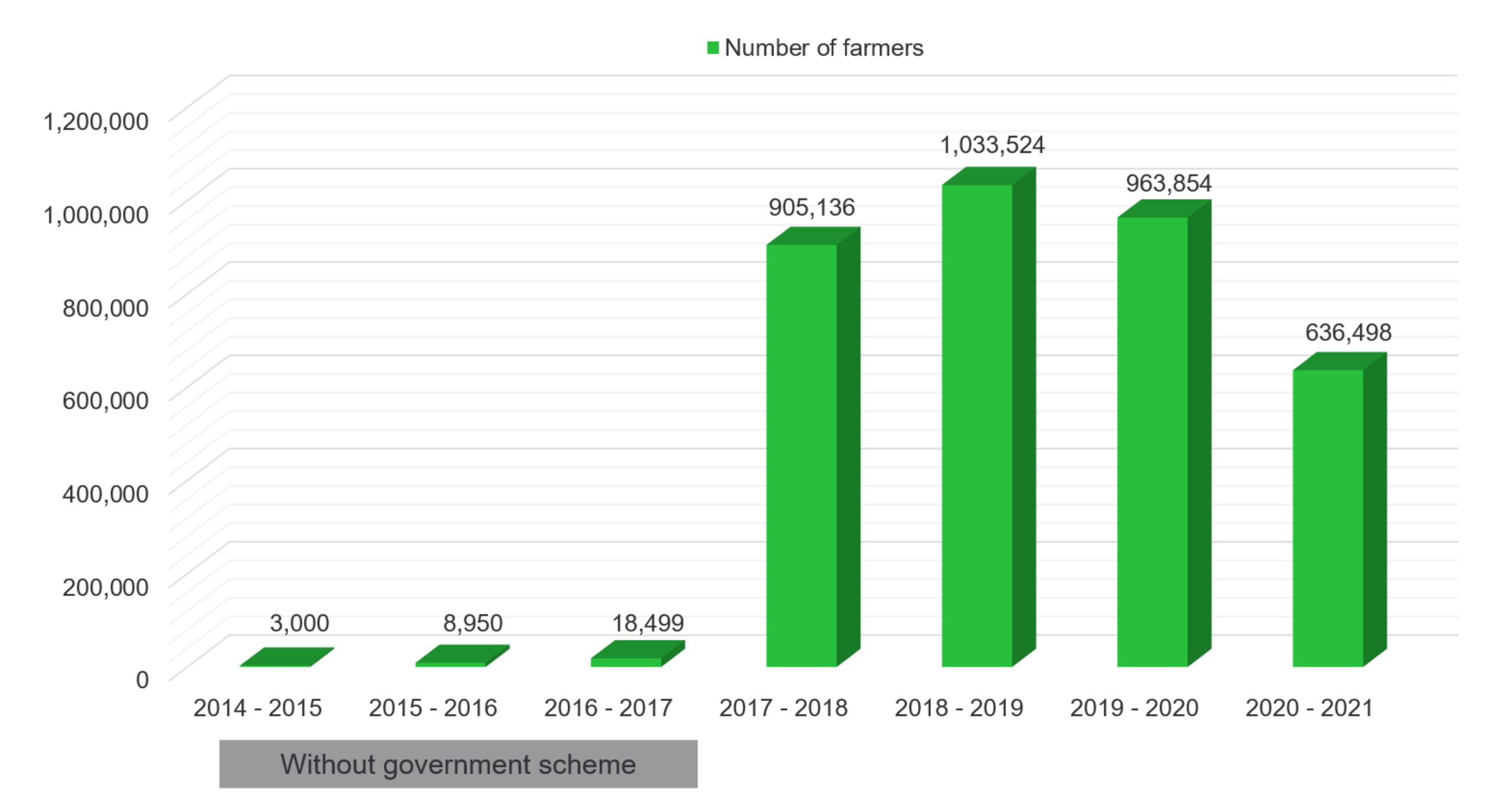

Tax exemption and market subsidies can enhance the affordability and accessibility of agricultural insurance. The National Agricultural Insurance Scheme (NAIS) in Rwanda includes government participation in the scheme in the form of smart subsidies for both crop and livestock insurance. In Zambia, Mayfair managed to drastically increase scale (see Figure 2) after embedding insurance into the government support scheme, the Farmer Input Support Programme (FISP).

Trust, awareness and education

Building trust in insurance heavily depends on demonstrating the value of insurance through payouts. Client acquisition must be accompanied by investments in education and awareness, leveraging practices best known to the targeted smallholder farmers. Hollard in Mozambique uses folk storytelling to educate farmers on agriculture insurance.

Scale is a success driver in agricultural insurance. Some of the private sector-led schemes usually experience low scale which increases steadily over time if the insurers persist with investment. For voluntary schemes, more smallholder farmers are likely to sign up only as they see the benefits for farmers. An aggregation approach or mandatory provision often helps with scale. Whether private sector-led or private-public partnership-managed schemes, inclusive agricultural insurance inevitably requires a long-term perspective towards investments. Practitioners shared their wish list in making inclusive agriculture insurance viable and this included subsidies, tax exemptions, more data on agriculture, increased scale through awareness and technology, cost-effective and reliable aggregation partnerships.

The view of the facilitators

A dedicated session with development agencies and technical service providers that have been involved in facilitating the design and implementation of agriculture insurance brought out some key lessons and recommendations. Access to Finance Rwanda, GIZ and Financial Sector Deepening Zambia were the key developing agencies on the table. These organisations have done a lot of work in supporting the development of inclusive agricultural insurance in Rwanda and Zambia. Celsius Pro and Risk Shield participated in this session as technical service providers.

The success drivers shared included integration of access to other agricultural financing mechanisms with insurance; working through contract farming value chains and working with aggregators. Investment in well-tailored sensitisation campaigns helps with client acquisition or sign-ups while claims experience helps with client retention and growth. The challenges highlighted by the market facilitators included finding proactive distribution channels, premium payment processes, low technical capacity among insurers, and robust and efficient claims payment processes. Most insurers also do not have expertise and experience in designing inclusive agriculture insurance schemes or products. Market facilitators have often supported product development through external technical assistance. Achieving sustainability may require insurers to build their skills for ongoing product development and enhancement.

While smart subsidies and external financing are required to stimulate investments in agriculture insurance products, caution is required on the potential disruption of prospects for sustainability. Clear exit strategies are required and supported market players must have a long-term commitment beyond support from development agencies. Unfortunately, some agriculture schemes have been wound up as soon as support has been withdrawn.

Across Africa, Latin America and Asia, agricultural insurance has been one of the core focus areas for inclusive insurance. Much work and support from development agencies are still required to arrive at sustainable and viable models. Improving resilience among smallholders has prospects of safeguarding and securing the futures of rural households and livelihoods.

About the event

%20copy.jpg/_jcr_content/renditions/original./Inclusive%20agriculture%20(06.09.21)%20copy.jpg)