Insurance for Development

An exciting online learning opportunity in times of pandemic

properties.trackTitle

properties.trackSubtitle

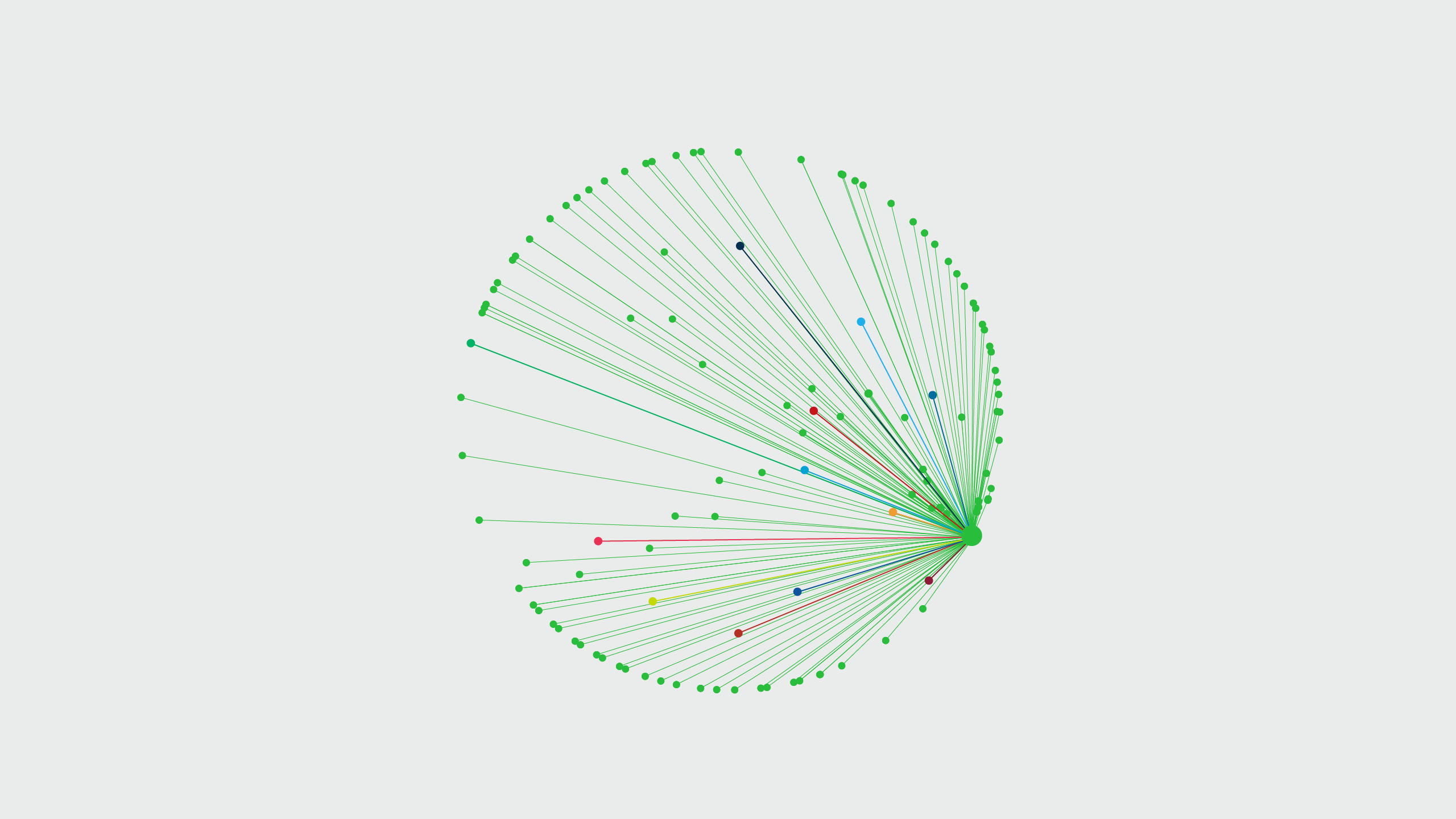

The “Insurance for Development” training hosted by the ILO’s Impact Insurance Facility took place from 28 September to 30 October 2020. Around 80 participants from 35 countries signed up for this online version of the training. The Munich Re Foundation sponsored the full or partial participation fees of 16 participants from the World Food Programme (which was recently awarded the Nobel Peace Prize), NGOs, microinsurance providers and representatives from supervisory authorities.

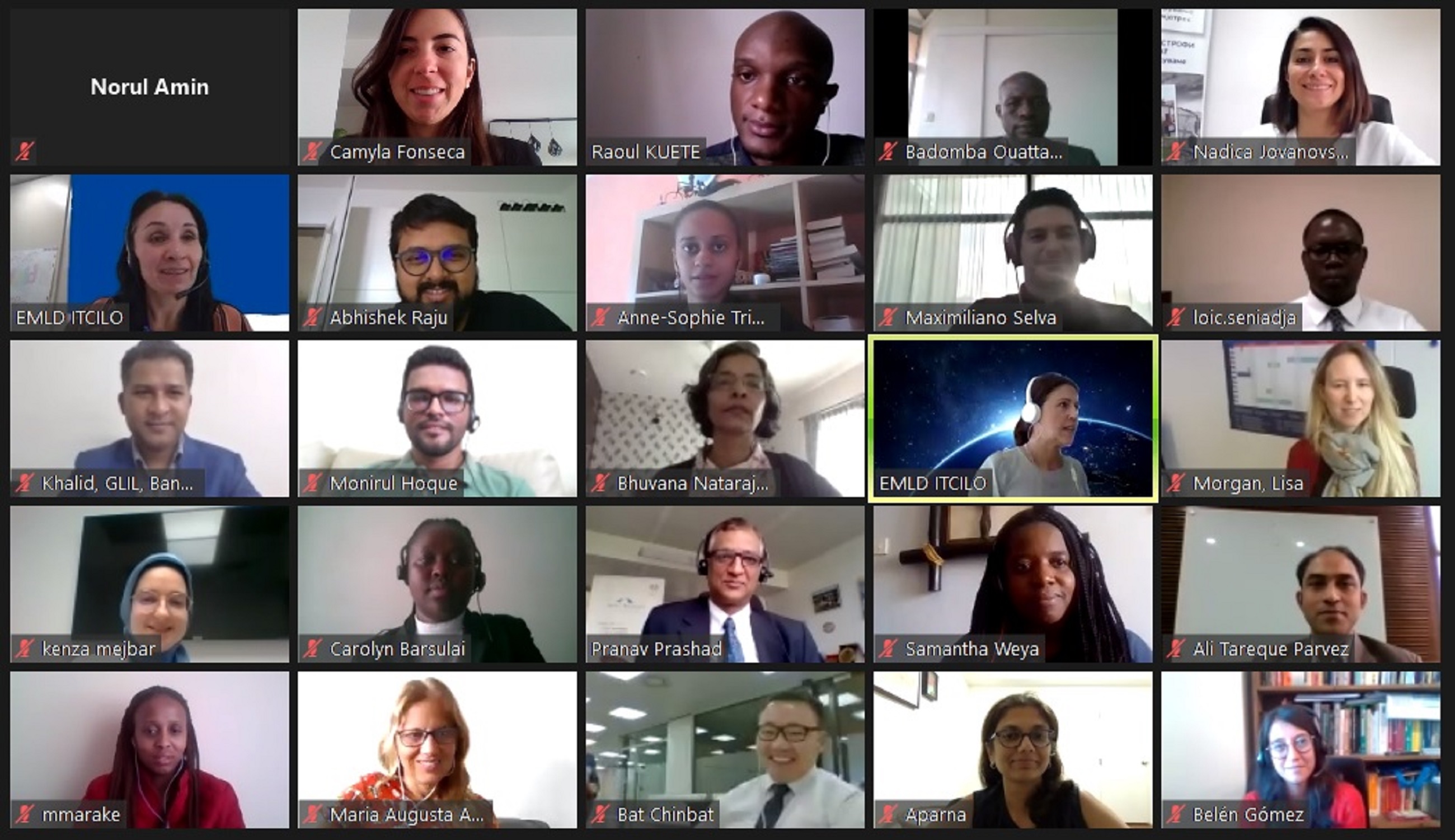

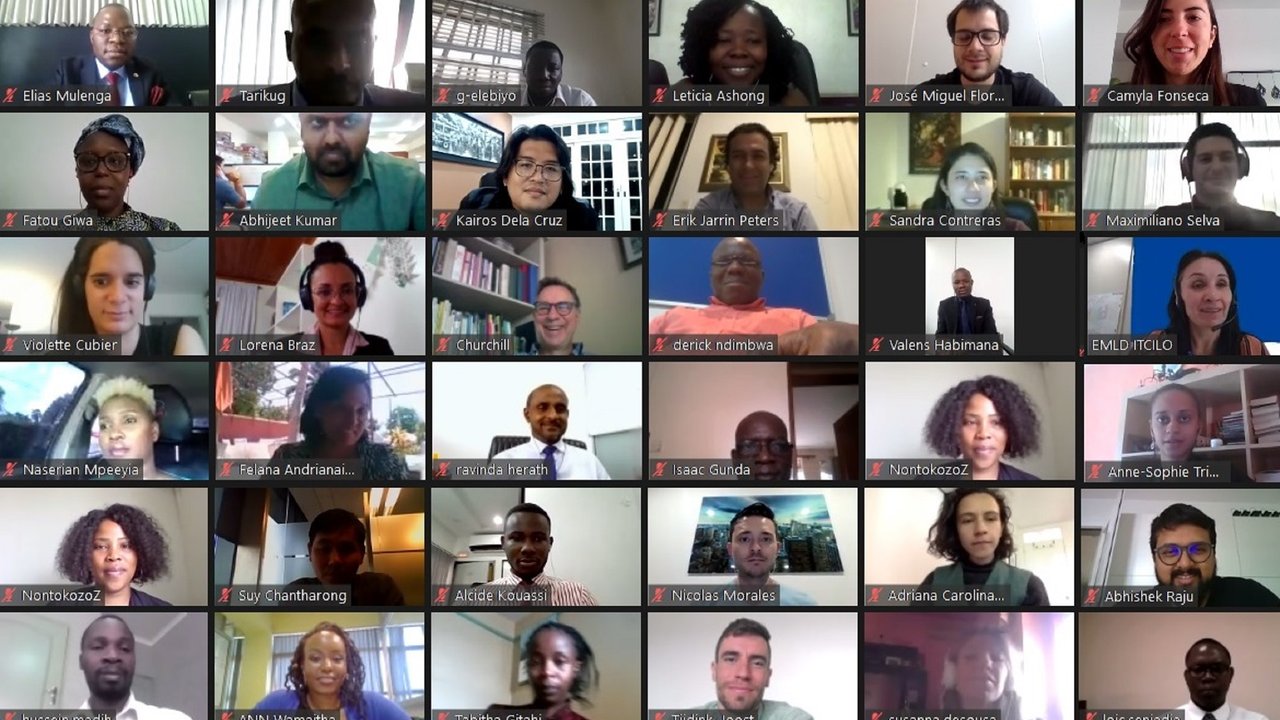

Over the course of five weeks, from 28 September to 30 October 2020, our 79 course participants from more than 35 countries revisited the entire insurance value chain, from market research and claims to product development and distribution, to learn how they can serve traditionally excluded customers in a responsible way. During each week, webinars kept participants engaged as a group, while individual assignments allowed them to put the knowledge learned in the self-paced lessons into practice.

The efforts have certainly paid off. The Insurance for Development online course created a truly vibrant and engaging learning community and showed us that the insurance sector is very interested to understand how it can contribute to the development agenda, especially if there is also a business case for it. With the help of technology, one can certainly say that the interactivity for which the facility’s face-to-face courses are known was not lost. More than that, the course also fostered connections between people who are passionate about making a difference.

If the COVID-19 pandemic has shown us anything, it is that access to quality insurance is now more important than ever, especially for informal workers and small businesses who may not have a safety net to rely on. Through this new online course, the ILO’s Impact Insurance Facility hopes to have inspired the insurance sector to take action and expand insurance coverage to such underserved markets in these difficult times.

For the future, the ILO is exploring the possibility of offering the same course in Spanish, to address the demand from participants who were unable to join our first version due to the language barrier.