A sleeping tiger in need of better protection

15th International Conference on Inclusive Insurance

5 - 7 November 2019, Dhaka, Bangladesh

properties.trackTitle

properties.trackSubtitle

0:00

Around 580 insurance and development experts from 42 countries took part in the 15th International Conference on Inclusive Insurance.

| Box 1: Climate and disaster risks insurance landscape – preliminary results |

|---|

| Almost all the nations considered have Disaster Risk Management (DRM) frameworks in place, looking at both pre- and post-disaster responses, but do not include insurance and disaster risk finance. These frameworks have so far focused on infrastructure, early warning and response mechanisms (Vietnam and Indonesia have taken some preliminary steps towards establishing insurance as a risk-financing mechanism). |

| In 14 of the 22 countries, contingency funds and reserves, together with ex post instruments such as national budgetary allocations and reallocations of about US$ 5bn, have been set up over the last 6 years. |

| Donor support remains critical for disaster response in most of the countries – in the same period, countries received a total of US$ 9bn in international post-disaster aid. But international aid is shrinking, which threatens post-disaster relief. |

| The regulatory frameworks in the region don’t yet enable climate and disaster risk insurance, as index-based or disaster insurance products are not specified in the existing regulations. |

| In the region, the study identified 25 interventions that qualify as climate and disaster risk insurance, with coverage for over 212 million people (8.5% of the region’s population). This includes insurance at the government level, as well as at the community and individual level. |

| The bulk of these people (171.8 million) are covered by five macro-level schemes. These are complemented by 14 meso- and micro-level agricultural and disaster insurance solutions, covering over 40.5 million farmers and fishermen. Five of these solutions are state sponsored (in India, the Philippines, Thailand, Sri Lanka and Indonesia), while the other nine are private-sector led. |

| For micro and retail disaster risk insurance products, distribution remains a key challenge. State-subsidised (and mandatory) products and bundled solutions tend to perform well. (India’s PMFBY crop insurance scheme is one example.) On the other hand, unsubsidised retail products tend to be less attractive to potential customers, and thus less commercially viable. |

| There is large untapped potential in the world of mobile solutions for disaster risk insurance. As some pioneering insurers have shown, app- and blockchain-based products can facilitate both the arrangement of insurance and claims handling. |

| Source: InsuResilience - First insights: Landscape of Climate and Disaster Risk Insurance (CDRI) in Asia and the Pacific |

The need to cooperate

Insurance has a long tradition in Bangladesh. The founder of the nation, Bangabandhu Sheikh Mujibur Rahman, was involved in the insurance industry. Today there are 79 insurance companies operating in the country. However, insurance penetration in Bangladesh stands at around 1% of GDP and is therefore among the lowest in the world. At the same time, the country has a very strong microfinance sector reaching nearly 40 million people, according to the national Credit Development Forum (CDF). Microfinance institutions (MFIs) in the country also provide some sort of risk protection in the form of credit life insurance. However, despite the huge potential for microinsurance in the country, the market doesn’t appear to be making progress.

Left to right: Thomas Loster, Chairman, Munich Re Foundation; Doubell Chamberlain, Chairman of the Board, Microinsurance Network; Asadul Islam, Senior Secretary, Financial Institutions Division; Mustafa Kamal, Finance Minister of Bangladesh; HE Sheikh Hasina, Prime Minister of Bangladesh; Sheikh Kabir Hossain, President, BIA; Shafiqur Rahman Patwary, Chairman, IDRA; Bangladesh; Prof. Rubina Hamid, First Vice-President of BIA

To pave the way for better cooperation, the various regulatory bodies and ministries need to work together to create an enabling regulatory environment, especially the Insurance Development and Regulatory Authority (IDRA) and the Microcredit Regulatory Authority (MRA). The various ministries involved in climate change adaptation measures need to coordinate their work. An overall national financial inclusion strategy could be the key for market development, by creating a framework to develop commonly accepted targets, involve all stakeholders and coordinate activities.

Steady growth with market clean-up

The market potential for inclusive insurance globally is huge. Insurance penetration similar to Bangladesh levels can be found in many other regions, especially in sub-Saharan countries. To better understand the development of inclusive insurance in the region, the Microinsurance Network (MiN) launched a study on selected African countries at the conference. The research was supported by the Munich Re Foundation and other donors.

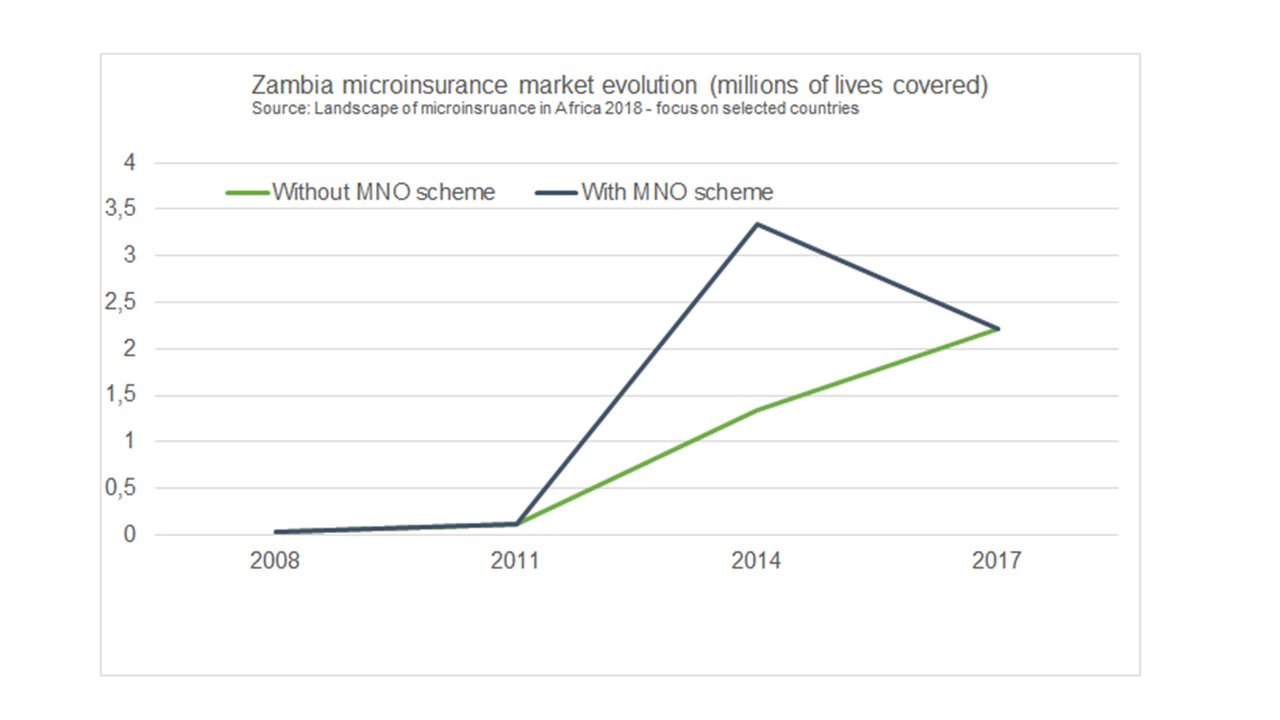

The study found interesting cases of fast-growing and then disappearing schemes in an overall growing microinsurance market. The introduction of a government-supported scheme boosted the market in Zambia, for example. And MNO-linked so-called “freemium” schemes, where mobile phone users automatically received insurance like a loyalty scheme, created an even bigger push. This freemium-business model was not sustainable, however, and disappeared, resulting in a reduction in the number of people covered from 2014 to 2017 (see Figure 1). However, looking at the overall market trend excluding these schemes, the figures show steady market growth.

Another positive finding of the study was the substantial growth of simple health products such as hospital benefits. Whenever an insured person needs to go to hospital, the scheme pays a lump sum. This can cover expenses such as medication, but also the cost of getting to hospital, which in many cases can be expensive and prevent people from accessing health services. The example shows that products that are well designed to meet customer needs can be successful and result in market growth.

Figure 1

What's next?

International cooperation and the exchange of knowledge remain key prerequisites for market development. The President of the BIA asked the Munich Re Foundation and other partners of the 15th International Conference on Inclusive Insurance to draft recommendations for the next steps to be taken to develop the country’s microinsurance and inclusive insurance sectors. The Munich Re Foundation will consolidate the recommendations and link the BIA with other organisations that have experience in developing national inclusive insurance strategies. We continue to provide a platform for discussing the opportunities for and barriers to the development of sustainable inclusive insurance. |

About the event

The 16th International Conference on Inclusive Insurance will take place in Kingston, Jamaica, from 10-12 November 2020. The conference will be hosted by the Insurance Association of Jamaica (IAJ) and the Munich Re Foundation, in cooperation with the Microinsurance Network.