International Conference on Inclusive Insurance 2021 -

Digital Edition

25 - 29 October 2021

#ICII2021

properties.trackTitle

properties.trackSubtitle

Inclusive Insurance in a (post) pandemic era

Scaping the landscape of inclusive insurance

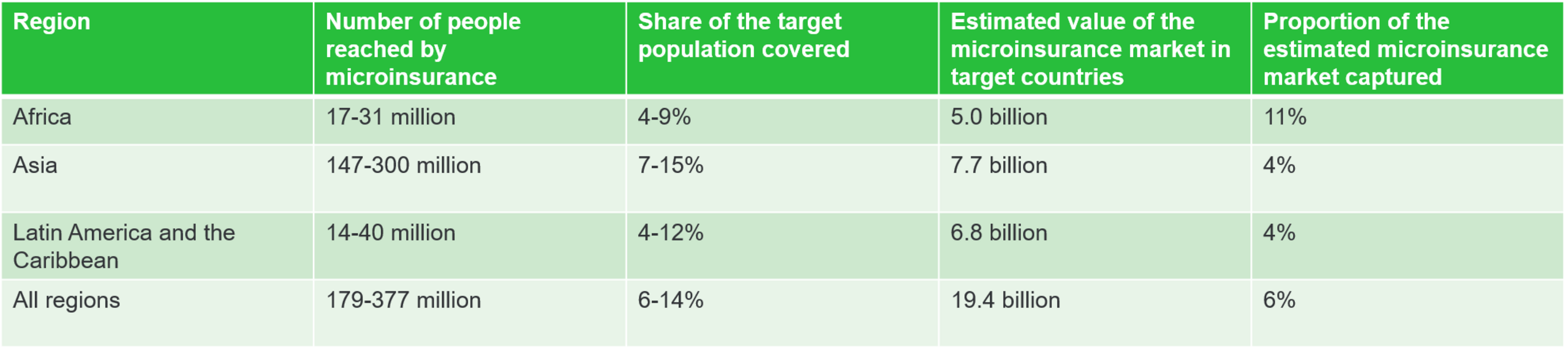

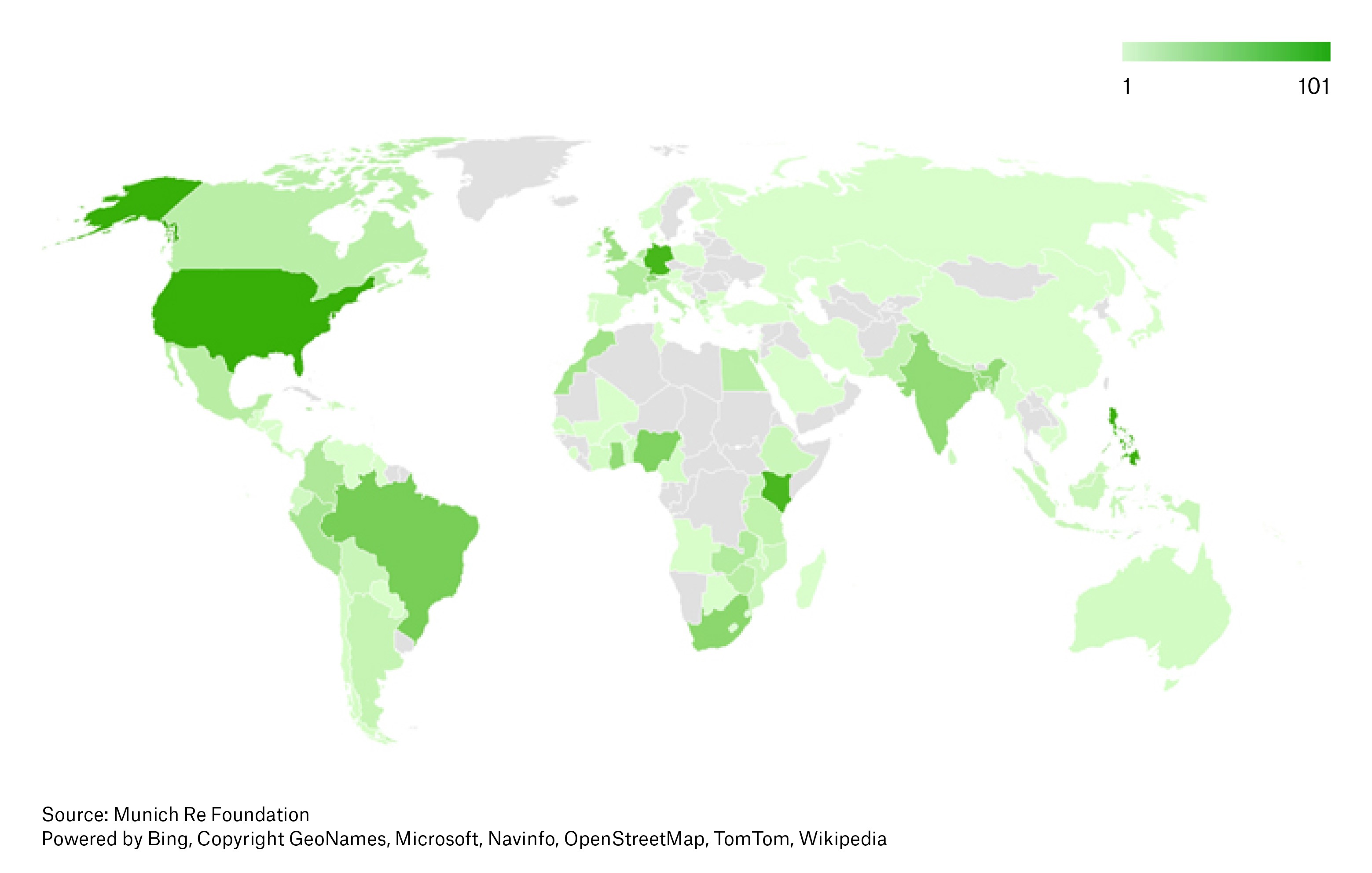

“If you can measure it, you can improve it” is one of the most commonly used quotes in business management. With this in mind, the Microinsurance Network's programme “The Landscape of Microinsurance” aims to shed light on the global status of inclusive insurance. According to the latest figures presented at ICII 2021, 377 million people in the 30 countries studied had some form of microinsurance coverage, representing between 6% and 14% of the target population.

Inclusive Insurance - The Jamaican Perspective

As part of the ICII 2021, the Insurance Association of Jamaica held a hybrid conference on 27 October, which was opened by the Hon. Nigel Clarke, Minister of Finance and Public Service of Jamaica. The following summarises some of his key messages:

Under this government we will be pursuing a broadening of the basis of the Jamaican economy, a deepening of the inclusiveness of the economy by making insurance accessible for all Jamaicans through a microinsurance policy framework.

The way in which the legislative framework has been developed so far does not easily allow for microinsurance to be developed, marketed and sold. The economic recovery has to be inclusive. The vast majority of Jamaicans are outside the formal financial sector where formal insurance is available. For them to be included, for their needs to be accounted for, we are going to have to create the legislative framework which forms part of the broader national financial inclusion strategy of the Government of Jamaica.

The Microinsurance Act, which is under drafting as we speak, will define microinsurance, will deal with the registration of microinsurance managers and will also deal with fit and proper requirements for those engaged in providing microinsurance services. It will require that microinsurance products have certain minimum terms and minimum contract requirements for all microinsurance products.

Climate and pandemic risks

Climate-related risks remain one of the key challenges in closing the insurance gap in emerging economies. Examples from the Caribbean showed that combinations of different risk management approaches on various micro, meso and macro levels can increase overall resilience. “We need more inclusive disaster risk financing” said participants at the conference. Neither government programmes nor microinsurance alone can provide a reliable and affordable safety net. Research presented at the conference indeed showed more maturing products with increasing scale as part of a more holistic safety net. However, most climate risk insurance is still heavily dependent on subsidies and more self-sustaining solutions are needed.

The challenge of reaching the client

One of the success factors for the growth of health insurance is the increased use of technology in enrolment and administration as well as on the part of healthcare providers. Telemedicine programmes from Indonesia, Thailand, the Philippines and Egypt, presented at the conference, have proven to be attractive, especially during the pandemic, and have improved access to health services. At the same time, understanding and trusting insurance remains a key challenge. Financial education should therefore build financial capability and requires a strategic approach as well as language that people understand, as in the cases of Ghana, Mozambique or Jamaica, which were presented at the conference. Financial education should start in school to educate the policyholders of tomorrow.

Finding efficient and trusted distribution channels remains a key factor for success. WhatsApp-enabled microinsurance in India or the combination of mobile-wallets with insurance in Kenya were examples of how to enter the mass market with established and trusted tools. The downside of the digitisation is that it might leave behind those who do not have access to digital solutions – as is frequently the case for women in many emerging economies – or simply do not know how to use them. Hence, combining digital with offline solutions should always be considered to make insurance more accessible.

The way forward

The COVID crisis poses a threat to global financial inclusion, but also opens up opportunities for insurers, digitalisation and public-private partnerships (PPPs). “Insurance needs to be integrated in the development agenda since it plays an important role in achieving the Sustainable Development Goals (SDGs)”, said UNDP representatives. The UNDP has recently launched its Insurance and Risk Finance Facility to achieve this through partnerships, convening, coordinating and trying to change markets and how they work.

A key challenge is to get interested insurers to offer insurance to low-income clients. “Insurers need to understand that more growth is possible towards the lower end of the market compared to the already highly competitive upper end of the market”, said Lorenzo Chan, CEO of Pioneer Insurance in the Philippines and Chair of the Board of the Microinsurance Network, at the closing of the conference.

Programmes like the InsuResilience Global Partnership, which held a joint session at the ICII 2021, or the Insurance Development Forum (IDF), have been successful in getting the attention of policymakers and large insurers. But also regional and national champions are crucial. The implementation of national financial inclusion strategies has proven successful, and more similar approaches are necessary. Risk management, including insurance, plays far too important a role in sustainable economic development, which must be acknowledged by all stakeholders. At the ICII, the Minister of Finance and Public Service of Jamaica announced a new law on microinsurance to be submitted to parliament by the end of this fiscal year. This can be a game changer and more governments acting like this are needed.

About the conference

We would like to thank the content partners of the ICII 2021:

- Microinsurance Network (MiN)

- Insurance Association of Jamaica (IAJ)

- Access to Insurance Initiative (A2ii)

- Centre for Financial Regulation and Inclusion (Cenfri)

- Center for the Economic Analysis of Risk (CEAR)

- Deutsche Gesellschaft für Internationale Zusammenarbeit (GIZ)

- Feed the Future Innovation Lab at UC Davis

- ILO’s Social Finance Programme

- InsuResilience

- Inter-American Development Bank (IDB)

- World Bank/IFC

- Microinsurance Master

- PharmAccess Foundation

- Sagicor

- World Food Programme (WFP)

Press release - ICII 2021

ICII 2021 - Conference Report

Download Conference Report ICII 2021

Read more about our previous conferences

| Year | Name | Country |

|---|---|---|

| 2020 | International Conference on Inclusive Insurance - Digital Edition | virtual |

| 2019 | 15th International Conference on Inclusive Insurance | Bangladesh |

| 2018 | 14th International Microinsurance Conference | Zambia |

| 2017 | 13th International Microinsurance Conference | Peru |

| 2016 | 12th International Microinsurance Conference | Sri Lanka |

| 2015 | 11th International Microinsurance Conference | Morocco |

| 2014 | 10th International Microinsurance Conference | Mexico |

| 2013 | 9th International Microinsurance Conference | Indonesia |

| 2012 | 8th International Microinsurance Conference | Tanzania |

| 2011 | 7th International Microinsurance Conference | Brazil |

| 2010 | 6th International Microinsurance Conference | Philippines |

| 2009 | 5th International Microinsurance Conference | Senegal |

| 2008 | 4th International Microinsurance Conference | Colombia |

| 2007 | 3rd International Microinsurance Conference | India |

| 2006 | 2nd International Microinsurance Conference | South Africa |

| 2005 | 1st International Microinsurance Conference | Germany |