International Conference on Inclusive Insurance 2022

Summary

24-28 October 2022, Kingston Jamaica

properties.trackTitle

properties.trackSubtitle

The challenge of reaching scale

The International Conference on Inclusive Insurance 2022 (ICII 2022) ended on 24 October, with around 250 participants from over 50 countries discussing how to make insurance more inclusive. The focus of the discussions this year revolved around solutions to cope with climate risks as well as how to address the specific needs of small (island) developing states.

Jamaica is set to become the first country in CARICOM to have microinsurance legislation with a bill to be tabled in 2023. This was announced by Jamaica’s Finance and Public Service Minister, Dr. the Hon. Nigel Clarke, at the International Conference on Inclusive Insurance (ICII), which took place between 24–28 October at the Jamaica Pegasus Hotel in Kingston.

According to Clarke: “This country has prioritised economic resilience. We take risk mitigation and insurance seriously. Access to finance is a critical pillar of sustained economic growth. We will table the microinsurance legislation in 2023. If we can’t have insurance available for the Jamaican citizen, there’s a cost that society bears – either directly or indirectly. We have a vested interest in making insurance more widely accessible and available in Jamaica. We will be the first country in CARICOM to have microinsurance legislation.”

Regulation plays a key role in reaching scale

Jamaica was the first Caribbean country to host the ICII since it started in 2005. The organisers chose the country to shed light on the specific needs of smaller countries. Reaching scale is one of the key challenges in making insurance for the low-income sector affordable. However, around 80 countries globally, including Jamaica, have a population of 3 million or less. Many are located in the Caribbean or the Pacific region and are particularly exposed to natural hazards like hurricanes and typhoons.

Sessions hosted by the Access to Insurance Initiative (a2ii) and UNCDF explored the best-practice guidelines for regulators, insurers and governments, and discussed how to create and enable environments for countries in the Caribbean and the Pacific region as well as for the development of index insurance[2] products. UNCDF is furthermore exploring how to better manage the risks of the over 280 million economically active migrants and their families. Regulation, however, remains the main challenge in this case as well since there are unanswered questions regarding cross-border selling of insurance and insurable interests across borders.

The Eastern Caribbean Currency Union (ECCU) developed a draft harmonised legislative framework for insurance and pensions within its member countries. The eight islands that make up the ECCU have a combined population of just 500,000, each with its own regulatory framework, thus requiring companies doing business across the region to seek separate licences and approvals in each country it wishes to do business in. Developing products for low-income individuals in each of these is a difficult business case. Developing common single-market rules, or recognising neighbouring countries’ insurance laws can ease market access and help providers reach scale. This is especially true for inclusive insurance. The main goal of this proposed framework is to establish one insurance and pension market across the eight member territories, with one robust and well-resourced insurance and pension regulator, and a uniform legislation benchmarked against international standards.

The consensus was that the ECCU framework would bring significant benefits for reducing the cost of cross-border business. However, the challenge remains as to how a single regulator would work in practice. This framework had been put on pause, but as a result of sessions held at the ICII 2022 discussions have restarted. Denis Felix, Executive Director Grenada Authority for the Regulation of Financial Institutions (GARFIN), expressed his commitment to finalising it and spoke of conversations he had with ECCB governor to get the bill finalised. He also made a “call for action” to industry in the ECCU to talk to the supervisor in their jurisdiction to request the framework be finalised.

Keeping this in mind, the new microinsurance regulation in Jamaica will most likely have an impact on the many CARICOM member states and associated members. With many companies operating not only in Jamaica but also in other countries, the insurance industry will have a strong interest in applying similar standards across the region.

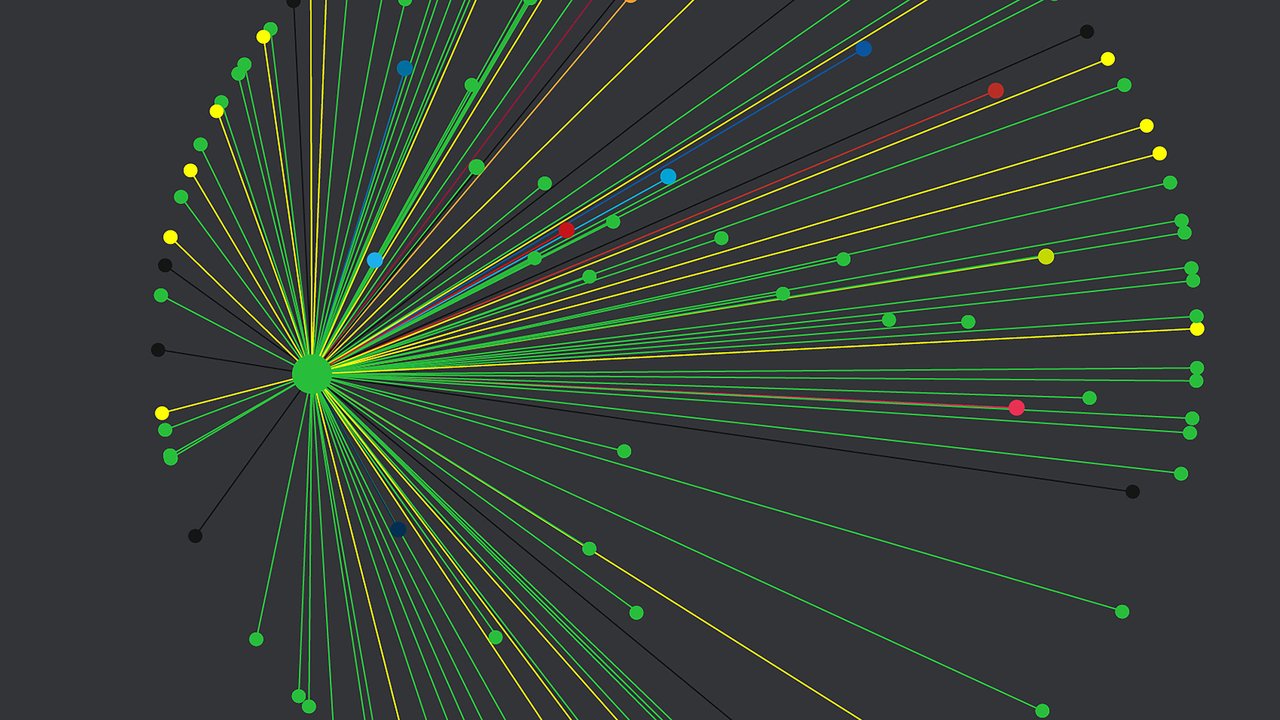

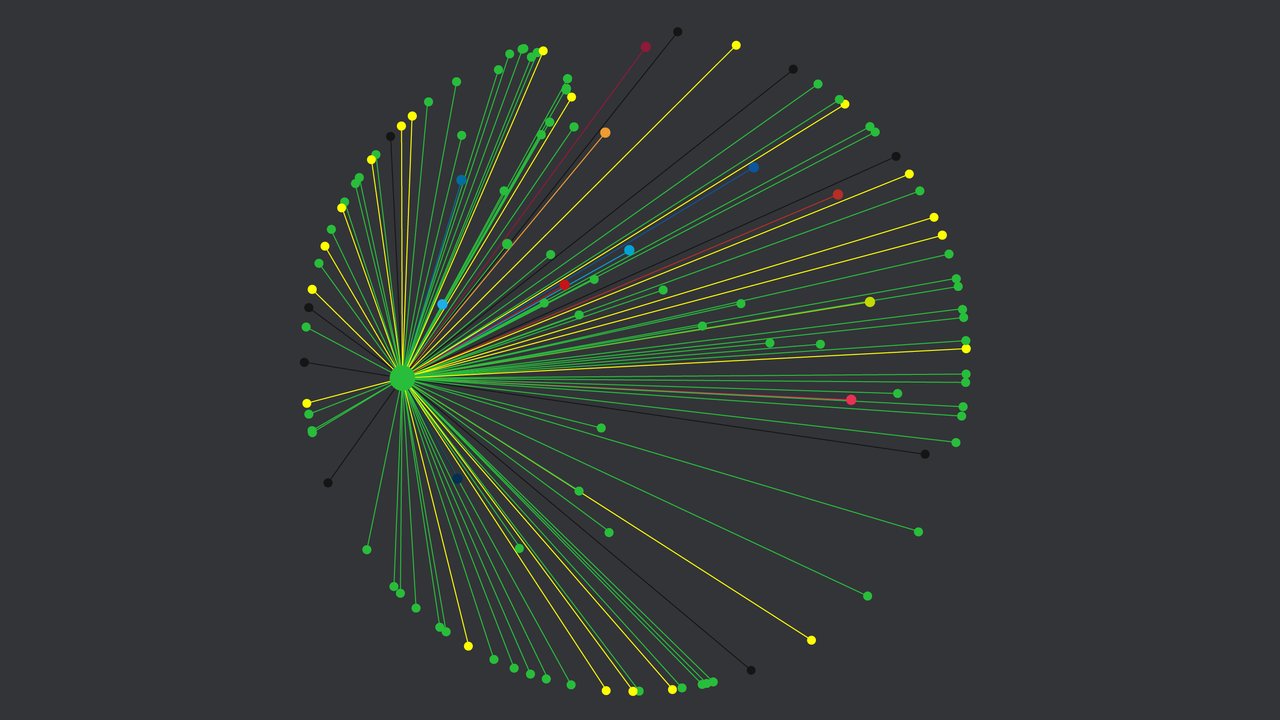

The landscape of microinsurance in 2021

According to the latest figures published by the Microinsurance Network at the ICII 2022, between 71m and 223m people were reported as covered in 2021 by a microinsurance product in the 34 countries included in the latest “Landscape of Microinsurance”[3] survey. The decrease observed in the number of policies and premiums in the microinsurance space in 2020 was almost reversed in 2021 with figures nearly at pre-pandemic levels. Life insurance products still account for the largest proportion of microinsurance products sold, followed by credit and health insurance. On the distribution side, microfinance institutions continue to be the largest distributors of microinsurance products followed by financial institutions and then brokers.

Increase outreach through partnerships

Setting up sustainable inclusive insurance products takes time and needs all stakeholders to have a long-term view as it will take time for profits to emerge and for the business to reach scale. For the insurance industry, public-private partnerships therefore play a key role. Various examples presented at the ICII 2022 have shown that outreach can be increased through cooperation between insurance providers with their specific expertise and governments that can provide the necessary regulatory and consumer protection framework, infrastructure and subsidies to get schemes started. The work of CCRIF in the Caribbean, for example, helped create an ecosystem for parametric index insurance in the region. Africa shows more good examples where the regional reinsurer Re has been working with 50 insurance companies across around 20 countries in Africa to provide support and build capacity.

As severity, frequency and predictability of extreme weather events are worsening, a global collaborative effort to build resilience against these events is needed. The “Global Shield” presented by GIZ at the conference aims at a coherent and sustained approach to strengthen the Climate and Disaster Risk Finance and Insurance (CDRFI) structure. In Zambia, using a PPP approach has been a success story in upscaling agricultural insurance, based on having a shared vision and common goals as success drivers. The IFC – through GIIF – has provided capacity-building support and a stop-loss facility. FSD Zambia and GIZ have supported farmer education initiatives and the Ministry of Agriculture has provided a client base to target.

The way forward

Closing the insurance gap needs more cooperative efforts by all stakeholders as well as new approaches, including the use of technology and new regulatory frameworks. The market is recovering from the pandemic. But still billions are left without protection especially against climate-related natural disasters. The International Conference on Inclusive Insurance will continue to play its role as a main platform to exchange knowledge and network to make the most vulnerable more resilient in Ghana, where the ICII 2023 takes place in Accra hosted by the National Insurance Commission of Ghana (NIC), the Ghana Insurance Association (GIA) and the Insurance Brokers' Association of Ghana (IBAG) in cooperation with the Munich Re Foundation and the Microinsurance Network.

About the conference

The International Conference on Inclusive Insurance 2022 was hosted by the Insurance Association of Jamaica (IAJ) and the Munich Re Foundation in cooperation with Microinsurance Network. Around 250 insurance and development experts from 50 countries signed up for the event. Speakers shared their knowledge in 26 sessions.

We would like to thank the content partners

https://www.munichre-foundation.org/en/Inclusive_insurance/International_Conference_on_Inclusive_Insurance/ICII2022/Content_partners.html

and sponsors of the ICII 2022:

https://www.munichre-foundation.org/en/Inclusive_insurance/International_Conference_on_Inclusive_Insurance/ICII2022/Sponsors.html

[2] Based on the joint publication by A2ii and the Pacific Insurance and Climate Adaptation Programme (PICAP) on index insurance best practices for insurance regulators and practitioners in the Pacific Island countries.

[3] https://microinsurancenetwork.org/the-landscape-of-microinsurance