International Conference on Inclusive Insurance 2023

Summary

23-27 October 2023

Accra, Ghana

properties.trackTitle

properties.trackSubtitle

The International Conference on Inclusive Insurance

2023: Accelerating growth and economic viability in emerging markets

By Rishi Raithatha and Dirk Reinhard

From 23 to 27 October 2023, the National Insurance Commission of Ghana (NIC), the Ghana Insurers Association (GIA) and the Insurance Brokers' Association of Ghana (IBAG), in cooperation with the Munich Re Foundation and the Microinsurance Network, organised the International Conference on Inclusive Insurance (ICII) 2023 in Accra, Ghana. Over 430 participants from 52 countries attended the inclusive insurance sector’s annual marquee event to exchange views and learn lessons on improving access to insurance in emerging markets. With several initiatives ongoing in Sub-Saharan Africa, the conference attracted new and regular participants who were able to attend engaging sessions or network.

I charge the Chair of the National Insurance Commission and the President of the [Ghana Insurers] Association that we ought to have a standing committee permanently to really delve into the issue of inclusive insurance so that we'll be ahead of the game.

Insurance is an essential financial service that can be used to mitigate and protect against these risks. Access to insurance is necessary to protect people from falling back into poverty, improve welfare and generally facilitate the attainment of the SDGs.

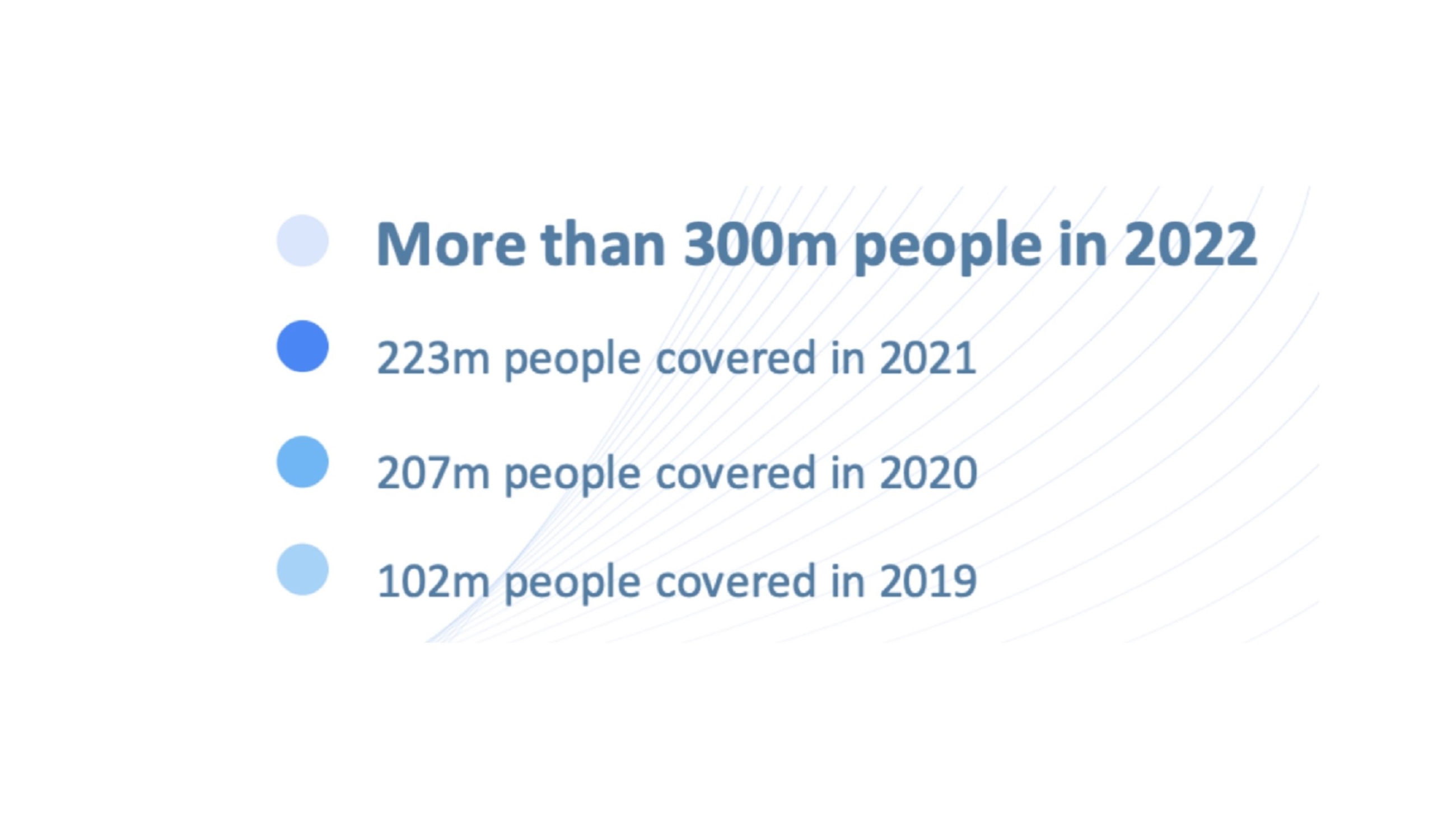

The Landscape of Inclusive Insurance

A major highlight of every annual ICII is early insights from the Microinsurance Network’s upcoming Landscape of Microinsurance, which showcases industry trends, and the progress of inclusive insurance products and services. The 2023 Landscape, due to be published in 2023, is the most comprehensive to date, with around 300 insurance providers surveyed across 36 countries in Africa, Asia, Latin America and the Caribbean. The study showed that 300 million people were covered by microinsurance products in 2022, up from 223 million in 2021 (Figure 1). Several factors have driven this growth: increased product variety, economic recovery and the associated increase in customers’ spending power.

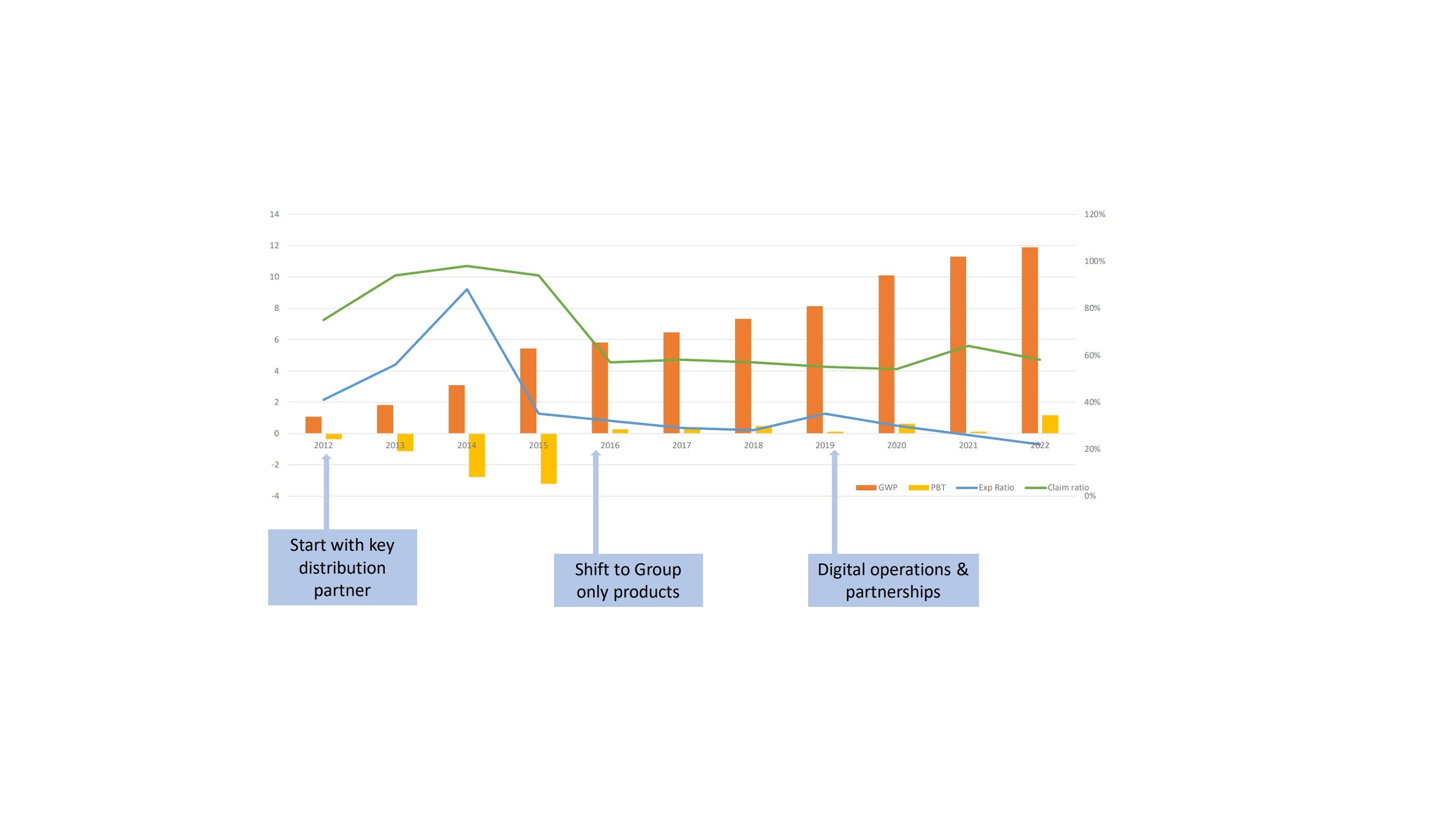

Business models: Why a long-term vision is necessary

For a business model to succeed, a long-term plan and a vision is necessary. Developing an impactful inclusive insurance scheme is a long-term goal. Many products have struggled to scale in the past due to a lack of a long-term perspective, affecting their associated business models at the same time. Britam Insurance’s shift to digital operations and partnerships is a good example of developing a long-term vision. Despite incurring losses between 2013 and 2015, the company changed its strategy twice and achieved scale and profitability.

Tackling the impact of climate change requires several approaches

Climate insurance can provide financial protection against extreme weather events, but its effectiveness can vary. Tailoring solutions to specific contexts and identifying inhibitors is essential. Several mechanisms can be used in tandem to improve climate resilience among the most vulnerable and bridge the climate finance gap. For instance, the InsuResilience Investment Fund offers equity, private debt, technical assistance, and premium support. Risk-layering is an important instrument too, as are premium subsidies for weather- or yield-based insurance schemes. However, these are not enough on their own; a collaborative effort is essential to develop an ecosystem that can manage multiple climate-induced risks.

Lessons from managing and overcoming the COVID-19 pandemic could apply to tackling climate change but need to be carefully led. This includes taking early action, raising awareness through education campaigns, addressing inequalities, and promoting global collaboration. Regulators and supervisors can play an important role in each of these initiatives. For instance, by encouraging risk assessment, incentivising risk prevention, and supporting financial literacy improvement campaigns. These drivers can be promoted through enabling regulation or national financial inclusion strategies.

Seen as a game-changer in overcoming the impact of climate change, the Global Shield can provide risk finance and empower countries to choose efficient protection instruments. The Global Shield can help countries close the protection gap by providing access to risk finance and guidance on risk finance instruments. For instance, as Ghana suffers from drought in the north, the Global Shield can help by supporting a macro-level risk transfer solution that specialises in drought cover. This may include premium support too: this is important for the Global Shield to demonstrate a first endorsement of insurance.

Women and migrants: Serving the underserved

Low insurance uptake by women can often be attributed to low levels of financial literacy. Implementing informal groups can tackle low financial literacy among low-income women, offering an alternative way to understand insurance. Building trust through identified advocates can empower shy or hesitant women to navigate the insurance landscape. For example, several women affected by a volcanic eruption in Tonga in January 2022 were able to access government loans and parametric insurance by joining the Tonga National Workers Council (a federation of workers’ associations in the country). These women had been exposed to financial literacy training in community groups, which increased their awareness of such support.

To promote gender inclusivity and reduce unconscious bias in insurance policies and marketing, regulation should encourage the collection of gender-disaggregated data. Such data can reveal that women are generally considered low-risk and hold significant value as policyholders. Or the fact that women often opt for low-premium products, reflecting their lower income levels. Prioritising demand-side input can reveal why women are underserved and help tailor products.

Like women, migrant workers are under-insured against the risks they face. To increase cover for them, clear and well-defined regulation is required. This can specify the roles and responsibilities of different stakeholders involved in providing financial protection to migrant workers and their families. Effective solutions require several stakeholders to work together to offer financial security to migrant communities. For example, IME Pay in Nepal has partnered with the United Nations Capital Development Fund and the Citizens Investment Trust to improve migrant workers’ financial security and access to financial services, particularly for individuals with visual impairments.

Distribution: MFIs still have significant reach, if staff are properly trained

Distribution is a key driver or inhibitor of inclusive insurance – while digital technology is usually desired to improve distribution, tried-and-tested approaches still have appeal. Examples from COMUBA in Benin and VisionFund in Senegal show that MFIs can ultimately be an effective distribution channel. However, selling insurance requires people who understand what it is and who understand customers and their needs. Agents responsible for selling credit would have to be trained to sell insurance for MFIs to prosper as inclusive insurance distribution channels. A poorly trained agent could be the biggest bottleneck even if there are brilliant growth strategies in place. This could lead to a bad customer experience, which would automatically create bad publicity.

We don’t know, what we don’t know. Coming here has been an eye opener.