The need for growing resilient economies

7th Eastern and Southern Africa Regional Conference on Inclusive Insurance

13 - 15 July 2022, Livingstone, Zambia

properties.trackTitle

properties.trackSubtitle

Currently 11 out of 30 companies in Zambia are active in the microinsurance market. For over ten years, the Zambian Microinsurance Technical Advisory Group (TAG) has acted as a stakeholder platform to facilitate market development and increase insurance outreach. Key challenges remain a lack of products and trust in insurance, insurance illiteracy as well as a lack of cost-effective solutions to develop, distribute and manage insurance products. Furthermore, a lack of the understanding of clients’ needs is still a key barrier. More market research is needed. Experience from Zambia has shown that diagnostic studies to understand demand and identify barriers has proven to be a successful starting point for market development activities. Experience from Zambia is also testament to what can be achieved through a strategic sector coordination platform that gets key stakeholders to work together for a common goal.

Growing the economies in Africa is important so that incomes can increase. ... The agenda to grow the economy (in Zambia) includes the reduction of barriers of access to products and services. [...] We want business to make profits. Business that is not making profits is useless. [...] When taxes are being reduced, insurance companies should put their profit back into business. ... Regulatory activities should be coordinated. [...] The challenge for the insurance industry is to make itself relevant. How can people understand that insurance is good for them?

According to the Centre for Strategic and International Studies, MSMEs account for 90% of the private sector and 50% of employment in Africa. But they are not yet seen by the insurance industry as key clients. MSMEs face a variety of risks that threaten their economic development. Holistic insurance solutions are needed that not only focus on indemnity but on proving a risk management service can make them more resilient and support economic growth.

Digital is the future and the future is now

Digitisation has been boosted by the pandemic. Mobile money, especially in the Sub-Saharan region, has been a true game changer that has substantially accelerated access to digital financial services. Fully digital processes in the provision of insurance solutions can reduce costs and increase outreach and create an easy customer journey. Well-managed partnerships such as ones between insurance providers and fintechs have proven to be successful, especially when interests were aligned and the individual roles were clearly defined and implemented.

However, because clients may have data protection concerns or may not be familiar with the use of digital solutions and the digital infrastructure is not always fully reliable, providers should always have additional options available to distribute and service insurance. Furthermore, going digital does not completely mean no physical contact to explain products to clients. Experiences shared by BIMA Ghana and AYO Zambia demonstrated strategic use of agents and call centres to provide insurance consumer education and product information. Nevertheless, the potential of digital solutions is huge. To fully explore the possibilities, innovation requires a sandbox approach which allows insurance providers to test new products in a defined environment.

Balance innovation and consumer protection

Insurance supervisors have the role to develop an enabling regulatory environment that can stimulate and support innovation, scale and commercial stability. At the same time, regulators need to look closely at market conduct, fair consumer outcomes as well as financial stabilities. Different regulatory approaches have been applied so far, such as specific microinsurance licences, defining product features for inclusive insurance as well as the definition of requirements for distribution channels and claims processes. In the case of Zambia, following the enactment of the new Insurance Act of 2021, inclusive insurance regulations are currently under development. The Insurance Act introduces a new licensing category for microinsurers. The inclusive insurance regulations will provide specific provisions and requirements for both conventional insurers undertaking inclusive insurance business and dedicated licensed microinsurers. The regulations for microinsurers will cover operating business requirements including but not limited to capital, governance structure and market conduct.

Industry representatives called for better coordination among the different regulatory entities as well as the different ministries that deal with the topic of inclusive insurance such as the Ministry of Finance and National Planning, Ministry of Health or Ministry of Agriculture. The lack of education among the public as well as inadequate data remains a challenge which can only be addressed in close cooperation between the industry and public stakeholders. The TAG continues to play a critical role and, as part of its forthcoming strategy, it seeks to establish an inclusive insurance education pool that will enable insurance companies, distribution channels, development agencies and government entities to pool their resources and work together to improve understanding of insurance and awareness of available products on the market.

The way forward in light of climate change

The importance of partnerships, not only with the government, was quoted many times throughout the conference. Successful partnerships must be developed on the basis of mutually agreed goals, long-term commitments and aligned interests to create value for all stakeholders, especially end-users of inclusive insurance solutions. Insurance schemes must be aligned with broader policy objectives such as increased access to finance, improved agricultural productivity, reduced vulnerability and enhanced social protection. The awareness of clients about the benefits of insurance must be increased. Agricultural income is particularly important in most Sub-Saharan countries. Making this sector more resilient against climate risks is hence a key concern. Insurance can help to make the agriculture sector as well as entire economies sustainable and resilient.

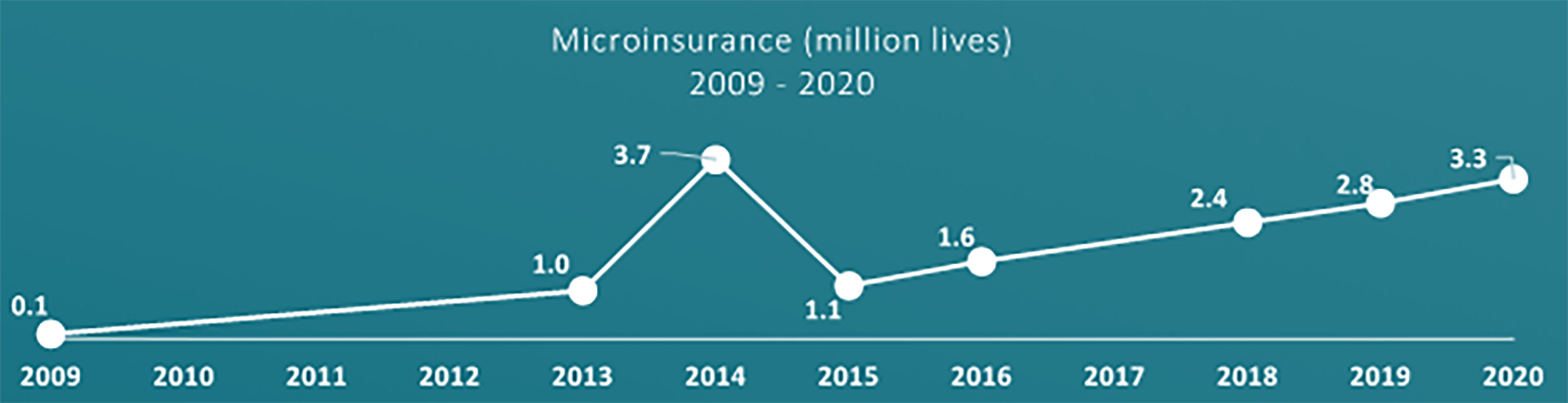

The Minister of Finance and National Planning asked the insurance industry to submit suggestions, concepts and proposals for inclusive insurance market development. Shipango Muteto, Chairman of the TAG, noted in his closing remarks that this will happen within a few weeks and announced that the TAG aims at doubling the number of lives insured from 5 million to 10 million in the next five years. A key element will be the launch of the new inclusive insurance regulations, the launch of TAG’s new strategy, increased private sector responsiveness to the inclusive insurance business as well as continued and increased participation of various public and private sector stakeholders in inclusive insurance sector coordination and market facilitation. The role played by development agencies like Financial Sector Deepening Zambia (FSD Zambia) and GIZ remains critical. Investments in the development of PPPs as well as the promotion of client-centric product development processes will be made and the development of micro pensions will be supported. Improving insurance culture take time; however, Zambia seems to be on the right path with inclusive insurance. For instance, increased uptake of funeral insurance policies is evidence that it is possible to break myths around death with strong value propositions for insurance and strategic consumer education. Ultimately, success comes when both private and public stakeholders stay with the goal of improving resilence of end-users; reducing vulnerability through better risk management for people regardless of their income or geographical location.

----------------------------------------------------------------------------------------------------------------------

About the event

The 2022 Eastern and Southern Africa Regional Conference on Inclusive Insurance was part of the series of regional learning sessions aimed at contributing to the development of inclusive insurance markets in Africa. The 7th regional conference was hosted by the TAG Microinsurance Association, Munich Re Foundation and FinProbity Solutions. The conference was supported by the Pensions and Insurance Authority (PIA), the Insurers Association of Zambia (IAZ), Financial Sector Deepening Zambia (FSD Zambia) and the Microinsurance Network.

DR 28.7.2022

Hosted by

Agenda

Pre-conference events - July 13

9:00 - 13:00: CEO retreat: Topline and Bottomline Strategies for Inclusive Insurance

Hosted by TAG & FinProbity Solutions

Lorenzo Chan

President, Pioneer Insurance, Philippines

> download presentation

Ovia K.Tuhairwe

CEO, Radiant Yacu, Rwanda

> download presentation

Agnes Chakonta

Managing Director, Madison Life, Zambia

> download presentation

Moses Siami

Managing Director, Professional Insurance Cooperation Zambia (PICZ), Zambia

Barbara Mwandila

Managing Director, Hollard Life Assurance, Zambia

> download presentation

Moderator

Lemmy Manje

Founder & CEO, FinProbity Solutions, Rwanda/Zambia

Pre-conference events - July 14

09:00 – 13:00: Digital Insurance Workshop: Trends, Models and Business Strategies for Digital Insurance

Hosted by FinProbity Solutions

Indira Gopalakrishna

CEO, Inclusivity Solutions, Singapore

> download presentation

Andrew Nkolola

CEO, AYO Zambia

> download presentation

Oscar Githinji Ng’ang’a

Business Development Manager, MEDbook, Kenya

Siani Malama

Business Development Manager, Democrance, Kenya

> download presentation

Facilitator

Jeremiah Siage

Co-Founder & Director, CoverApp, Kenya

> download presentation

Facilitator

Lemmy Manje

Founder & CEO, FinProbity Solutions, Rwanda/Zambia

> download presentation

Conference agenda - July 14

14:00 - 16:00: Session 1: The Landscape of Inclusive Insurance in Zambia

Shipango Muteto

President, TAG Association/Zep-Re, Zambia

Engwase Mwale

CEO, FSD Zambia, Zambia

Dirk Reinhard

Vice Chair, Munich Re Foundation, Germany

Keynote Speech

Craig Churchill

Chief - Social Finance Programme and Team Leader - ILO Impact Insurance Facility, Switzerland

Moderator

Mauwa Lungu

Director - Financial Services Supply, FSD Zambia, Zambia

Landscape presentations

Mark Robertson

Knowledge Manager, Microinsurance Network, South Africa

> download presentation

Landscape presentations

Lemmy Manje

Founder & CEO, FinProbity Solutions, Rwanda/Zambia

> download presentation

16:30 - 18:00: Session 2: Developing and regulating inclusive insurance markets

Anselmi Anselmi

Microinsurance Coordinator, Tanzania

Elias Omondi

Senior Manager – Risk Regulations, FSD Africa, Kenya TBC

Yizaso Musonda

Manager – Ag Market Development, Pensions and Insurance Authority, Zambia

Moderator

Janina Voss

Advisor, A2ii, Germany

> download all presentations from Session 2

Conference agenda - July 15

09:00 – 10:30: Session 3: Digital Insurance

Indira Gopalakrishna

CEO, Inclusivity Solutions, Singapore

> download presentation

Andrew Nkolola

CEO, AYO Zambia

> download presentation

Valerie Labi

Country Director, BIMA, Ghana

> download presentation

Menna Alla Hegazy

General Manager, Fawry insurance brokerage, Egypt

Moderator

Jeremiah Siage

Co-Founder & Director, CoverApp, Kenya

11:00 – 12:30: Session 4: SME Insurance

Melinda Grace Labao

Head of Microinsurance, Pioneer Insurance, Philippines

> download presentation

Violet Kapeleke

Inclusive Insurance Manager, Hollard Insurance, Zambia

> download presentation

Jeremy Gray

Resilience lead, Cenfri, South Africa

> download presentation

Mwenda Kwendakwema

Head of Partnerships and Innovations Vision Fund, Zambia

> download presentation

Kennedy Siamuwele

Ag CEO, ZSIC Life, Zambia

14:00 - 15:30: Session 5: Health insurance

Dr. Lydia Dsane-Selby

CEO, National Health Insurance Scheme (NHIS), Ghana

> download presentation

Jacob Chirwa

Project Lead, NHIMA, Zambia

> download presentation

Rahel Musyoki

Healthcare Advisor, Kenya

> download presentation

Moderator

Ayandev Saha

Head - Climate Risk Adaptation and Insurance, KMD Dastur & Company London, United Kingdom

> download presentation

16:00 – 17:30: Session 6: Agricultural insurance

Ashok Shah

CEO, APA Insurance, Kenya

> download presentation

Joyce Chirwa Mlewa

Country Director, Pula Advisors, Zambia

> download presentation

Pranav Prashad

Technical Expert- Social Finance and Impact Insurance, ILO Impact Insurance Facility, Switzerland

Joseph Chegeh

Commercial Portfolio Manager, ACRE Africa, Kenya

> download presentation

Ayandev Saha

Head - Climate Risk Adaptation and Insurance, KM Dastur & Company London, United Kingdom

Dirk Reinhard

Vice Chair, Munich Re Foundation, Germany

16:00 – 17:30 Closing session - Summary and key messages

Summary of the conference

Dirk Reinhard

Vice Chair, Munich Re Foundation, Germany

> download presentation

Agnes Chakonta

Managing Director, Madison Life, Zambia

19:00 – 22:00 TAG Gala Dinner

Guests

Titus Kalenga (Sky Reinsurance Brokers), Juliet Munro (FSD Africa) and Doubell Chamberlain (Cenfri)

Host

Collins Hamusonde

CEO, ABSA Life, Zambia

Supported by