Why leadership and ownership are key to grow inclusive insurance markets

8th Eastern and Southern Africa Regional Conference on Inclusive Insurance

24 - 26 April 2023, Nairobi, Kenya

properties.trackTitle

properties.trackSubtitle

By Rishi Raithatha and Dirk Reinhard

From 24 to 26 April 2023, the Insurance Regulatory Authority of Kenya (IRA) hosted the 8th Eastern and Southern Africa Regional Conference on Inclusive Insurance. Nearly 150 global participants convened in Nairobi, Kenya, to share their experience of inclusive insurance from the region and beyond. Held annually on rotation, the conference combines plenary sessions and training workshops to explore progress on improving access to insurance. The event was co-hosted by the Munich Re Foundation and the Association of Kenya Insurers (AKI). The conference has been supported by Africa Re, APA Insurance, AB Consultants, Britam, CIC Group, FSD Africa, the Microinsurance Network, IDF's Inclusive Insurance Working Group, Old Mutual and FinProbity Solutions.

The 8th ESARCII brought together actors involved in inclusive insurance value chains to talk about ongoing initiatives designed to close protection gaps. Attendees included insurers and reinsurers, brokers, distribution channel providers, international organisations, non-governmental organisations, development-aid agencies, policymakers, regulators and supervisors in Africa. While the topics explored included several types of inclusive insurance, such as climate risk and agriculture, health and micro, and small and medium enterprises (MSMEs), the discussions generated valuable comparisons between each topic on common issues. These include leadership and ownership, product design, regulation and the role of government, and technology.

The case for inclusive insurance…is one that we need to deliberately pursue if we intend to increase the safety nets and financial cushions...

Regional focus: the landscape of inclusive insurance in East and Southern Africa

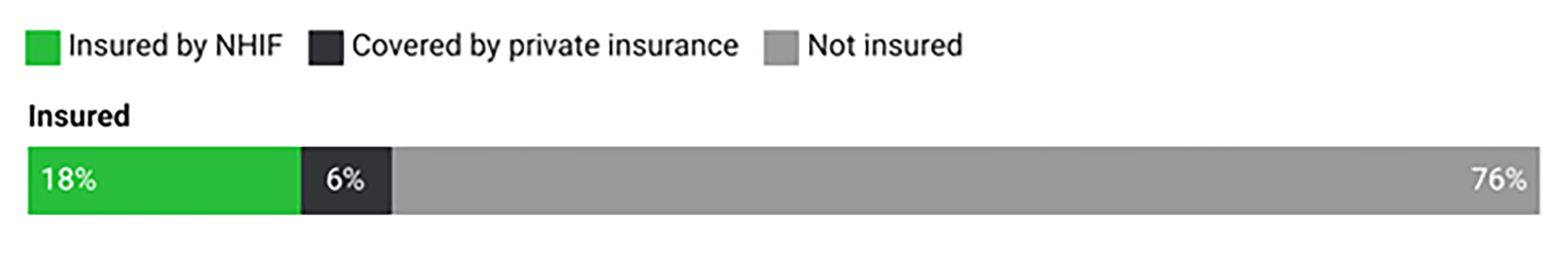

The recently published Landscape of Microinsurance 2023 found that eight per cent of emerging consumers in the 34 countries surveyed had insurance in 2022. The Landscape found that the number of people covered by inclusive insurance in 2022 (eight per cent) was lower than in 2021 (14 per cent) – partly due to the COVID-19 pandemic. According to SOTIR, around 18 per cent of mobile money providers surveyed offered insurance – typically through a partnership.

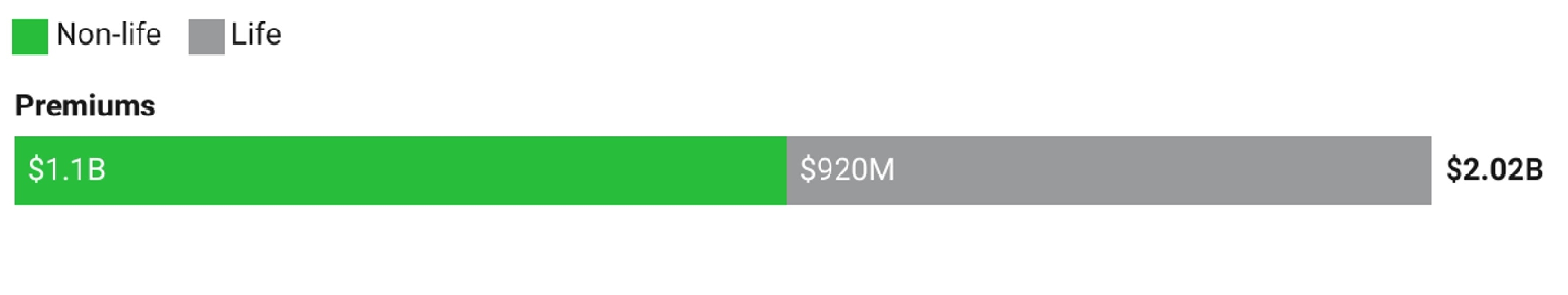

Based on the Landscape of Microinsurance 2023, trends in East and Southern Africa show a region where some countries are at the forefront of growth in Africa. Across Kenya, Rwanda, South Africa, Tanzania, Uganda, Zambia and Zimbabwe, an average of 10 per cent of emerging customers had insurance – two percentage points higher than the global average. However, the averages per country are likely to vary significantly. Impressively, this adoption rate can be attributed to a wide-ranging product mix (Figure 1) that varied by country: health insurance in Kenya, funeral cover in South Africa, Zambia and Zimbabwe, and agriculture insurance in Uganda.

| Kenya | Rwanda | South Africa | Tanzania | Uganda | Zambia | Zimbabwe | |

|---|---|---|---|---|---|---|---|

| Health | 62% | 0.10% | 36% | 1% | |||

| Life | 13% | 7% | 0.10% | 64% | 99% | ||

| Funeral | 8% | 37% | 91.10% | 0.70% | 75% | 66% | |

| Credit Life/ Loan Protection | 12% | 8.10% | 23% | 6% | |||

| Personal Accident | 0.60% | 5% | |||||

| Property (non-Agri) | 6% | 0.00% | |||||

| Other | 0.50% | 1% | 0% | ||||

| Investment/ Savings | 1% | ||||||

| Agriculture (crop/ livestock/ fishing/ aquaculture) | 10% | 45% | 0.30% | 1% | 20% |

Figure 1: Share of gross premiums in USD by product line (based on reported data)

Source: The Landscape of Microinsurance 2022, Microinsurance Network

Improving insurance literacy requires awareness and education. This is so important as [these qualities] can influence perception and trust

Regulation and the role of governments: is there a new blueprint?

Regulation remains one of the most important barriers for inclusive insurance services to overcome for growth. Kenya’s insurance regulator – the IRA – has played a prominent role in enabling the growth of microinsurance products and services. In 2012, the IRA recognised microinsurance as a separate class of general insurance. Previously, microinsurance was considered part of life or general insurance business.

The IRA has played a unique and proactive role in attempting to change the landscape of inclusive insurance in Kenya. Despite a perceived high level of demand, the IRA found that the insurance law in Kenya was hindering the growth of microinsurance. The new regulations introduced reporting requirements that are proportional to the type of risks being covered. They also permit underwriting for specific types of customer groups, e.g., bicycle taxi riders’ savings and credit unions. However, unlike traditional insurance, microinsurance licences must be renewed annually as they are not long-term products. This allows the IRA to maintain close regulatory oversight.

Box 1: Kenya’s microinsurance regulation at-a-glance

In 2020, the Kenyan government passed new insurance laws designed to support and grow microinsurance as a separate line of business. The new regulations allow for standalone microinsurance companies to encourage more targeted innovation. These “intermediaries” need not be registered as a traditional insurer. Existing insurance underwriters keen to continue in microinsurance were given three years, until February 2023, to transition their microinsurance businesses to a subsidiary. The minimum risk-based capital required to incorporate a standalone microinsurance business was set at KES 50 million (US$ 368,000). Daily premiums cannot exceed KES 40 (US$ 0.30), while the sum insurable per policy is limited to KES 500,000 (US$ 3,700).

The new regulations provide guidelines on the criteria microinsurance products need to fulfil to receive approval in Kenya. Providers are expected to have done their research on the market need for the product and demand among target customers. Claim payments have to be made within 10 days, while complaints have to be resolved within seven days. Consumer education is fundamental for any product, especially as many consumers may not even know that they can complain. For underwriters with a microinsurance subsidiary, decision-making must be shared between the board of directors and management.

Efficiency is key to microinsurance. It is about the right product, right price and settled as soon as possible (within 24 hours)

Some regulators are actively involved in public-private partnerships

Similar to the IRA, Rwanda’s insurance regulator has played a key role in developing microinsurance-specific regulation – one of the earliest markets to do so. As part of this, the National Agricultural Insurance Scheme (NAIS) was launched in 2019 as a public-private initiative, originally with three insurers and now involving five insurers in total. The government provides a 40 per cent premium subsidy, with farmers covering the remaining 60 per cent. Covering a range of export and subsistence crops, the scheme has allowed up to 150,000 farmers to benefit from insurance coverage each season.

Beyond regulatory support, government leadership is important and has enabled progress for a range of inclusive insurance programmes, including the World Bank’s DRIVE and the WFP’s R4 Rural Resilience initiative. Public-private partnerships (PPP) require significant government involvement to be successful. Rwanda’s NAIS has continued to scale partly due to the government anchoring the scheme and providing a premium subsidy. For the World Bank’s DRIVE programme, the governments in Ethiopia and Kenya respectively have supported pastoralist aggregation to aid product distribution. The WFP’s R4 Rural Resilience Initiative has benefitted from government support too – both in the form of premium subsidies and in defining roles in a PPP.

Insurance means securing the life of your loved ones. There is a need to sensitise people…from a young age and develop a culture of savings and insurance to improve penetration

Leadership and ownership are often a missing prerequisite

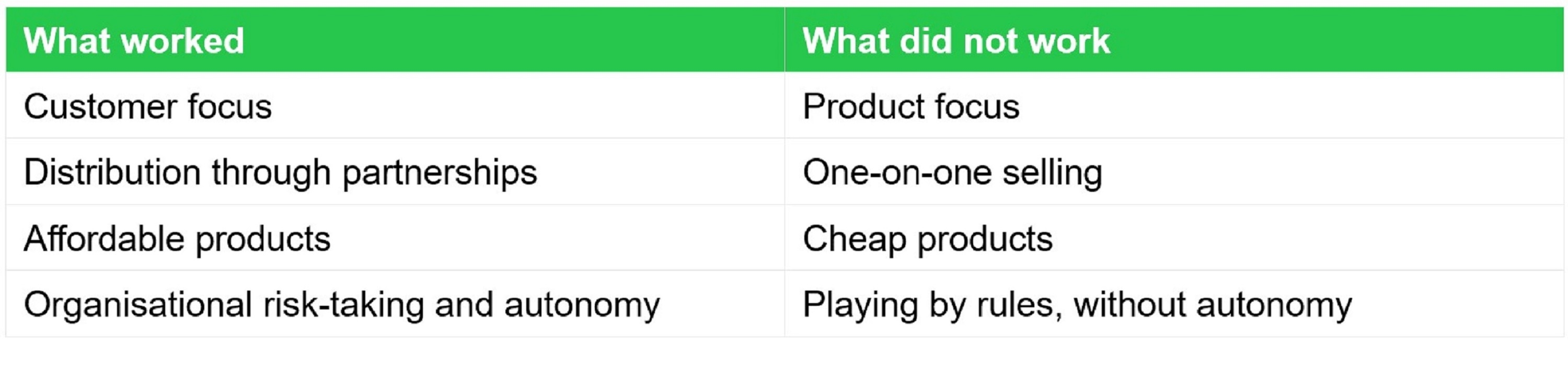

While inclusive insurance products and services have been around for nearly two decades, some old challenges still limit progress in certain markets. Understanding customer needs to create customer-centric products is now a well-articulated approach for any financial service provider serving populations in low- and middle-income markets. However, microinsurance has suffered disproportionately from traditional products being “shrunk” and tailored for low-income customers; this has not always worked. To overcome this and create a culture of customer-centricity, industry leaders need to understand microinsurance and how it works, and customers’ needs.

With several well-known inclusive insurance players in attendance, there was near-unanimous agreement on the need for good ownership and leadership for inclusive insurance services to succeed and grow. Ownership can be thought of in at least two different ways: local insurers can take ownership by using their knowledge to complement their partners’ efforts, while executive ownership can enable underwriting capability development and increased investment. For effective ownership, it is necessary to have a leader who is passionate and knowledgeable about microinsurance, and who promotes respectful stakeholder collaboration. Effective leadership involves providing support to develop capacity. For instance, the technical skills required to develop microinsurance products are often acquired because of support from company leaders.

The ecosystem needs much more than premium support from donors. We should deploy a product that works, and requires innovation and technical support. Innovation should be based on what suits Africa

APA Insurance in Kenya represents a good example of where effective ownership and leadership have led to sustained growth over several years. APA Insurance started selling weather index insurance for smallholder farmers in 2006, but has since moved on to provide area-yield index insurance. It has played a leading role in creating a consortium of seven insurers that work together in underwriting agricultural risks. This has not prevented the companies from competing on other lines of insurance. As a group, the insurers could take on 20 per cent of the risk, which allowed them to place the remaining 80 per cent with global reinsurers. Their stance as an industry was the primary reason for reinsurers taking on agricultural risk in Kenya.

Beyond Africa, Pioneer Microinsurance (Pioneer) in the Philippines has also benefited from effective ownership and leadership, and a company-wide entrepreneurial drive to show a business case for inclusive insurance. In its first year, Pioneer has 27,000 customers and US$ 0.5 million in premiums collected. A decade later, the company has 11 million unique individual policies and US$ 32 million in premiums collected. Microinsurance has become the second-largest business line and the biggest income generator for the Pioneer Group. Key to this was creating a separate microinsurance team, led by a change champion who sat just below the Group CEO – at a level where key company decisions were made. This separate business unit took on all customer experience functions, demonstrating that growth can be driven through value creation.

Customer-centric product design

Rwanda’s NAIS also provides a valuable lesson on how to design a product that is specific not only to customers’ (farmers’) needs, but to the environment too. While several agricultural insurance programmes – both crop and livestock – have been launched after a feasibility study, it is important for ground-based studies to consider the exact risks that farmers face. Crop insurance typically covers droughts, floods and locust infestations. But beyond this, farmers’ crops are often damaged by wild or stray animals. Regional variations, even in small areas, mean that microclimates may present localised risks: eastern Rwanda is prone to drought, while the north is at risk of flooding. Rwanda’s NAIS covers all these risks.

All the inclusive insurance examples highlighted at the event had one thing in common: the importance of strong and mutually beneficial partnerships. APA Insurance and Pioneer have used a similar range of partners to distribute their products. This includes aggregators that work with farmers and farmer groups, rural co-operatives and microfinance institutions. APA Insurance has also explored bundling its insurance product with pay-as-you-go solar panel providers. Inclusive insurance providers whose product is offered via digital technology also require strong partnerships. aYo, a mobile-enabled microinsurance provider, uses a highly effective multi-channel distribution strategy, while BIMA, a mobile-based telemedicine provider, started out through a partnership with Airtel Ghana (now Airtel-Tigo). Now, the company relies on partnerships with several healthcare providers to offer on-demand telemedicine to its customers.

Partnerships are crucial for success. We are not trying to reinvent the wheel of a car. We just need to put fresh air into the wheels

Technology and innovation are key to industry growth, but require patience

Digital technology has played an important role in enabling and scaling different types of inclusive services, including health, agricultural and MSME insurance. The conference looked at how the evolution of technology had seen inclusive insurance services change in their own way. With some of the earliest inclusive insurance services focussing on covering health, BIMA in Ghana started out by deducting premiums from customers’ airtime balances, aYo’s progress offers an example of how to distribute microinsurance in partnership with a mobile money provider.

Beyond repurposing and improving existing products, technological advancement has led to the creation of new products and services. Climate risk insurance has significantly benefitted from technological advancement. For instance, the availability and use of data, real-time monitoring, design techniques and ground-truthing have enabled the WFP’s R4 Rural Resilience Initiative to offer better-quality products to a wider customer base. Complete value chains have also benefitted from technology, with new value chains created entirely because of digital tools. Democrance, a platform provider, uses digital technology for its value chain from end to end. This covers customer acquisition, product development, distribution, premium collections, business intelligence, and document management and claims processing. Using this approach, Democrance has enabled leading insurers to sell more microinsurance policies using technology.

Innovation is something where we may not see the results immediately

Technology has allowed traditional insurers to develop microinsurance services and enabled existing traditional structures to take advantage of digital use cases. Britam Insurance in Kenya created an online portal to improve communication with hospitals. The portal allows registered hospitals to check if patients have health insurance and their level of cover, and to submit claims to Britam. The manual process would take between 60 – 80 days; the portal brought the processing time down to 10 days. Technology can also be adapted to traditional community-based resilience mechanisms. Jamii One has developed an app for community groups to track group savings and borrowing. This app has been used in Ethiopia by insurers, such as Nib Insurance, to provide group micro life insurance to hundred-year-old mutual groups, known as edir. Using a digital tool has minimised bureaucracy and simplified claims processes for the edir.

Digital tools have the potential to significantly expand insurance in Kenya: 61 per cent of Kenyans use a smartphone, while 45 per cent use mobile money daily. To take advantage of Kenya’s increasing use of technology, the IRA set up the Bima Innovation Lab. Now managed by FSD Africa, the Lab is an accelerator that allows insurtechs to develop new products, try out customer journeys and allow the regulator to develop regulations designed to promote growth and innovation. The goal of the Lab is to connect technology, talent and trends to increase insurance penetration and coverage, and develop supportive legislation. Most insurtechs and innovators typically struggle and fade away in the “valley of death”. To overcome this, the Lab offers a combination of funding, technology skills and regulatory clarity. The Lab expects to have served one million customers by 2025.

The business case for inclusive insurance is clear

The foremost lesson learned from the event was from the experiences of Pioneer in the Philippines and Britam in Kenya: both proved that there is a strong business case for inclusive insurance. This not only encouraged many attendees, but it validated the IRA’s stance on promoting inclusive insurance and seeing it as a driver to increase insurance penetration in Kenya. Britam’s case offers an important lesson in making changes to a business model and taking calculated risks. The company was previously involved in the Linda Jamii initiative with Safaricom in Kenya, a health microinsurance product that encountered challenges and was discontinued in 2016. This venture was not a complete failure: it showed that MSMEs and individuals demanded insurance and could afford it.

With several speakers encouraging more innovation and collaborative action, the event set a standard for future conferences to serve as a benchmark and demonstrate real progress. Recognising that incremental gains are simply not enough, several industry leaders expressed a desire to see more effort by all actors involved in inclusive insurance. Regulators in Kenya and Rwanda have displayed a level of flexibility and leadership for others to adopt and build on. Insurers in Ghana, Kenya and Zambia have prioritised innovation to develop products that offer customers value and an adequate level of protection. The launch of accelerators, such as the Bima Innovation Lab, not only offers insurtechs the chance to experiment without consequence, but also shows an insurance sector attempting to function in harmony. These examples show a young but vibrant inclusive insurance ecosystem in Sub-Saharan Africa – with significant potential for future growth.

Agenda

Pre conference events - April 24

09:00 – 10:30 / Pre conference workshop - session 1

Inclusive Insurance remains a blue ocean for insurance companies in many developing financial markets. Over the years, there has been steady growth recorded in some markets. This pre-conference workshop presents insights on strategies and business models from successful inclusive insurance providers. This interactive work retreat is designed for CEOs or senior executives in insurance companies who interested increasing their investments and footprint in inclusive insurance business. The sessions aim to demonstrate how inclusive insurance providers can make inclusive insurance viable and profitable while providing superior client value for their customers.

Facilitated by FinProbity Solutions and AB Consultants, the workshop features international and regional inclusive insurance leaders. The workshop will address the following:

- What business strategies can be employed by market players to achieve better results in Inclusive Insurance business?

- What organizational structure is ideal for pushing Inclusive Insurance in a company?

- What sort of institutional culture and work-style is ideal?

- How can shareholders support senior management in pushing Inclusive Insurance in insurance companies?

This workshop brings together international, regional and national CEOs to share strategies that can be used to make inclusive insurance work in Africa.

Speaker

Dr. Nelson Kuria

Board Chair, CIC Group, Kenya

Geric Laude (online)

Head of Non-Life Retail, Pioneer Insurance, Philippines

Andrew Nkolola

CEO, aYo Zambia, Zambia

Hadil Abdel Kader (online)

Head of Emerging Consumers and Public Affairs, AXA, Egypt

Facilitators

Lemmy Manje

CEO, FinProbity Solutions, Rwanda/Zambia

Anne Kamau

Director, AB Consultants, Kenya

11:00 – 12:30 / Pre conference workshop - session 2

Workshop cont.

Speakers

Israel Muchena

Head of Life and Agriculture insurance, Hollard, Mozambique

Saurabh Sharma

General Manager - Microinsurance, Britam, Kenya

> download presentation

Zufan Abebe

CEO, Nib Insurance, Ethiopia

> download presentation

Charlotte Rønje

CEO, Jamii.one, Denmark

> download presentation

Ashok Shah

Group CEO APA Apollo Group, Kenya

> download presentation

Facilitator

Lemmy Manje

CEO, CEO, FinProbity Solutions, Rwanda/Zambia

Anne Kamau

Director, AB Consultants, Kenya

Conference agenda - April 24

14:00 - 15:00 / Opening

Speakers

Hazel King’ori

Manager of PR, Research and Education, Association of Kenya Insurers (AKI), Kenya

Dirk Reinhard

Vice Chair, Munich Re Foundation, Germany

Godfrey K. Kiptum

Commissioner of Insurance, IRA, Kenya

Hon. Mwambu Mabonga

Chairman, Board of Directors, Insurance Regulatory Authority, Kenya

Samson Palia Wangusi

Principal Administrative Secretary, National Treasury and Economic Planning, Kenya

Facilitator

Noella Mutanda

Manager - Corporate Communication, IRA, Kenya

15:30 - 16:30 / Session 1: The Landscape of Inclusive Insurance in Southern and Eastern Africa

In this session, current figures on the Landscape of Inclusive Insurance in Southern and Eastern Africa as well as in Kenya will be presented. It will provide the basis for further discussions during the conference.

Speakers

Katharine Pulvermacher

Executive Director, Microinsurance Network, Luxembourg

> download presentation

Anne Kamau

Co-founder and Director, Cover App, Kenya

> download presentation

Facilitator

Robert Kuloba

Director, Research, Innovation, Policy & Strategy, IRA, Kenya

Conference agenda - April 25

9:00 - 10:30 / Session 2: How to enable market development

Reducing this insurance gap is not the exclusive responsibility of the insurance sector. It is also a responsibility of governments and states through their public policies and developing an enabling regulatory environment. It is a task that must be carried out in a framework of public-private collaboration. Due to the low existing coverage of climatic and catastrophic risks, states must spend more and more to cover losses to the population, losses that should be insured. That is why the definition and proposals of national strategies and policies for insurance inclusion are needed. Policies and action plans defined at the highest level of government are required. It is important to give a greater priority and level of importance to the dialogue between the insurance sector and government authorities. The session will discuss how to design a national inclusive insurance strategy and explore how insurance supervisors can create environments that enable scale and innovation while at the same time protecting consumers, and that look at what lessons can be learnt from around the world.

Speakers

Mary Nkoimu

Senior Manager, Prudential Supervision, Insurance Regulatory Authority, Kenya

Jean Bosco Iyacu

CEO of Access to Finance Rwanda, Rwanda

> download presentation

Dr. Tarek Seif

Secretary General, Insurance Federation of Egypt, Egypt

> download presentation

Pedro Pinheiro

Coordinator, Insurance Development Forum’s (IDF) working group on inclusive insurance, Microinsurance Network, Luxembourg

> download presentation

Japheth O. Ogalloh

Managing Director, Old Mutual General Insurance Kenya, Kenya

> download presentation

Facilitator

Lemmy Manje

Founder and CEO, Finprobity Solutions, Rwanda/ Zambia

> download presentation

11:00 – 12:30 / Session 3: Climate risk and agricultural insurance

Households, farmers, entrepreneurs and enterprises need to prepare for various risks and safeguard their economic activities. Insurance generally provides the most cost-effective cover against severe events, while risk retention, contingent credit or shock-responsive loans or reserve funds are usually well suited to cover less severe events with higher frequencies. The affordability of climate risk insurance solutions remains a key issue. Developing effective climate and disaster risk finance solutions requires ‘risk layering’. The combination of macro-, meso- and micro-level climate and disaster risk finance and insurance plays a vital role in strengthening the resilience of the vulnerable and poor. The session will discuss the current development of insurance schemes, including parametric (index-based) products aimed at protecting low-income clients/farmers/MSMEs against natural disasters in the region and beyond.

Speakers

Isaac Magina

Agriculture Underwriting and Marketing Manager, Africa Re, Nigeria

> download presentation

Sylvia Mwangi

Project Lead, DRIVE project, Zep-Re, Kenya

> download presentation

Ashok Shah

Group CEO, APA Apollo Group, Kenya

> download presentation

Khalai Duncan

Regional Advisor, Climate Risk Transfer, East and Central Africa Region, World Food Programme, Kenya

> download presentation

Facilitator

Dirk Reinhard

Vice Chair, Munich Re Foundation, Germany

14:00 – 15:30 / Session 4: Health Insurance

Ensuring Health Insurance coverage for all members of society is a viable way to achieve Universal Health Coverage (UHC). The rise of (mobile technology) offers the prospect to transform health insurance by increasing coverage, building transparency, and reducing costs. The session will feature examples how mobile technology and digital solutions are increasing health insurance enrolment and improving access to quality healthcare. Panellists will also discuss current challenges, and the opportunities for scaling digital health tools to improve financing and delivery of care.

Speakers

Sosthenes Konutsey

Founder of Farmer Welfare Africa and Head of service operations, BIMA, Ghana

> download presentation

Saurabh Sharma

Director Emerging Consumers, Britam, Kenya

> download presentation

Dana Ellis

Senior Operations Manager, Swiss Capacity Building Facility, Switzerland

> download presentation

Juliet Maara

Social Protection Expert, National Hospital Insurance Fund (NHIF), Kenya

> download presentation

Facilitator

Elias Omondi

Senior Manager, Risk and Regulations, FSD Africa, Kenya

16:00 - 17:30 / Session 5: MSME Insurance

MSMEs are the backbone of many developing economies that represent large shares of global business and employment. Businesses need to prepare for climate change impacts and safeguard their business continuity. Appropriate risk management, including access to insurance, is key to catalysing business growth. This session will consider the insurer business model constraints when serving MSMEs and discuss how insurance providers can meet different MSMEs’ risk management needs. While microbusinesses, which often blur the lines between business and personal needs, are usually the prime target market for inclusive insurance, the distinct risk management needs of larger, aspirational but still small enterprises go largely unmet.

Speakers

Vera Neugebauer (online)

Research Associate, Cenfri, South Africa

> download presentation

Hon. Simon Kiprono Chelugui

EGH - Cabinet Secretary - Ministry of Cooperatives and MSME, Kenya

Tamara Cook

FSD Kenya, Kenya

> download presentation

Facilitator

Barbara Chesire

Managing Director, AB Consultants, Kenya

Conference agenda - April 26

9:00 – 10:30 / Session 6: Inclusive digital insurance models

Inclusive Insurance represents a gigantic business opportunity. However, entry barriers are high and Inclusive Insurance programmes must be self-sustainable and profitable. Technology is a key enabler for innovation and hence plays a particular role in developing sustainable business models. Digital platforms and new data aggregators are broadening the potential for digital finance services to reach clients who were previously excluded. At the same time, a digital service frequently requires offline backup, and technical applications have various limitations. The session will discuss the benefits and challenges of using the technology.

Speakers

Andrew Nkolola

CEO, aYo, Zambia

> download presentation

Siani Malama

Director Sub-Sahara Africa Region, Democrance, Kenya

> download presentation

Elias Omondi

Senior Manager, Risk Regulations, FSD Africa, Kenya

> download presentation

Jihan Abbas

CEO, Griffin Insurance, Kenya

> download presentation

Facilitator

Jeremiah Siage

Agent Network Management Specialist, International Finance Corporation (IFC) / Cover App, Kenya

11:00 – 12:30 / Closing, outlook and next steps

This session will summarize some learnings from the conference and discuss the next steps. It will also discuss the findings from the IDF working group in Inclusive Insurance Kenya Meeting and develop tasks and a workplan for the future.

Speakers

Dirk Reinhard

Vice Chair, Munich Re Foundation, Germany

> download presentation

Pedro Pinheiro

Coordinator, Insurance Development Forum’s (IDF) working group on Inclusive Insurance, Microinsurance Network, Luxembourg

Panelists

Kalai Musee

Senior Manager, Supervision, Licensing & Enforcement, IRA, Kenya

Tom Gichuhi

Executive Director, Association of Kenya Insurers (AKI), Kenya

Israel Muchena

Head of Life and Agriculture insurance, Hollard, Mozambique

Jean Bosco Iyacu

CEO of Access to Finance Rwanda, Rwanda

Closing remarks

Godfrey K. Kiptum

Commissioner of Insurance, Insurance Regulatory Authority of Kenya, Kenya

Facilitator

Noella Mutanda

Manager - Corporate Communication, Insurance Regulatory Authority of Kenya, Kenya

14:00 – 17:00 / Field Trip

Hosted by

APA Insurance and BRITAM, Kenya